Driven by expectations of a soft economic landing and potential Federal Reserve interest rate cuts, U.S. stocks rose 4.5% in December, extending the momentum that began in November. The S&P 500 closed the year with nine consecutive weekly gains, the longest streak since 2004, finishing the month just 0.6% below its January 2022 record close. The small-cap Russell 2000 also had its best month since November 2020, gaining 12.2%. The so-called “Magnificent Seven” stocks trailed as December witnessed a rally in speculative investments, including a strong performance for junk bonds.

The December rally was fostered by the FOMC meeting when the Fed confirmed a shift toward rate cuts in 2024. In the updated Summary of Economic Projections, a.k.a. the Fed’s “Dot Plot”, the forecast for the median Fed funds rate is in the range of 4.5-4.75% by the end of 2024, down from a projection of 5.0-5.25% in September. This pivot sets the Fed’s expectations at three rate cuts in the upcoming year.

This shift in stance encouraged investors to increase their own rate cut expectations, which were already overly optimistic. Surveys show investors expect double the number of rate cuts that the Fed is projecting. While rate cuts are generally good for investors, a wide disconnect between investor expectations and economic reality reflects an environment where markets are likely to experience bouts of volatility.

Economic data for December supported the soft-landing narrative with disinflation gaining traction. Despite some positive economic indicators such as November payrolls beating expectations, there were revisions to the previous two months, and average hourly earnings gains slowed. The JOLTS report showed job openings fell for the third straight month to the lowest level since March 2021, reflecting a cooling but persistently strong labor market.

However, despite the rally in the past two months, we believe investors should have grounded expectations. We are optimistic, but some patience is warranted given that markets may have fully priced in the most optimistic Fed rate cut scenarios, posing short-term downside risks if the Fed does not meet these expectations.

Capital Markets

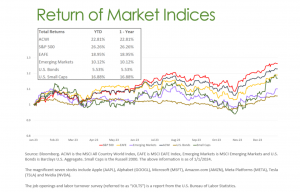

The All-Country World Index (ACWI) was up 22.81% for the year, the S&P 500 was up 26.26% and the EAFE up 18.95%. Emerging market equities and U.S. Small caps lagged but were up 10.12% and 16.88% for the year, respectively.

Treasuries saw a rally across the yield curve, with the 2-year yield dropping by nearly 0.45% to 4.25%, the lowest since May. The 10-year yield also decreased by almost 0.50% to just above 3.85%, the lowest since July. 6-month Treasury Bill yields declined slightly to 5.26%.