Debt Ceiling Limit – A Game of Chicken

Congress is facing a stalemate on raising the debt ceiling limit as Republicans and Democrats continue a dangerous game of brinksmanship. If the debt ceiling is not raised by June, the United States could default on interest due on its debt jeopardizing the country’s reputation and credit rating. From a credit perspective, the U.S. is generally perceived as the safest borrower and a re-evaluation of our creditworthiness could increase interest rates and further slow US economic growth.

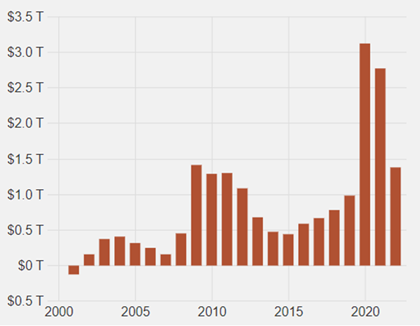

The debt ceiling limits the amount the US Treasury can borrow. The reason the U.S. government is hitting the debt limit, yet again, is because most years the government spends more than it receives in taxes. The annual shortfall is referred to as ‘the deficit’. Each year that we run a deficit, it increases the debt load. Below is a chart showing the annual deficit and the amount added to the debt load each year:

Annual Federal Deficit

Source: US Treasury 9/30/22

At a basic level, deficits are not always bad. The U.S. government needs flexibility to run deficits, especially during recessionary periods. During the pandemic and shutdowns, the U.S. government spent $5 trillion in stimulus programs which helped support families and the U.S economy. To pay for this stimulus, the government issued debt and the deficit increased sharply. Ideally, after the economy recovers, governments should return to a balanced budget.

Currently, the total Federal debt stands at $31.4 trillion, a number so large it is hard to comprehend. The is the equivalent of $93,870 per every living person in the States. Yikes!

To the brink!

For the current Republican-led Congress, Kevin McCarthy was elected speaker of the House of Representatives after 15 rounds of voting. During this process he offered many concessions, one of which was to force spending cuts with any bill extending the debt ceiling limit. Since McCarthy controls the voting agenda in the House, he can effectively block any bill not to his liking.

Democrats seem equally motivated to protect their priorities. Since 2020, Biden and the Democrats enacted several hard-won legislative victories including the Infrastructure and Jobs Act and Inflation Reduction Act, which ushered in broad changes to spending and taxes. Few Democrats will be keen to make cuts to these programs.

The debt ceiling debate will require compromise which seems in short supply in today’s charged political environment. Heightened bipartisanship, especially in Congress, further raises concerns that one party could be influenced by their more extreme members despite the massive financial and historical implications of defaulting on our debt.

Tough choices

The current deficit is enormous. For 2023, the Congressional Budget Office projected the deficit to be $908b, a sizable 15% of total outlays. Spending cuts to close this gap will be substantial and painful. Further, many big spending areas are politically untouchable like Social Security, defense, veteran benefits, and interest on debt. Balancing the budget would require significant cuts to the ‘touchable’ areas like healthcare and social services.

Treasury’s options

Having reached the debt ceiling, the Treasury has stopped payments to government-controlled retirement plans which buys time. The Treasury can still pay wages and interest on debt until sometime in June.

There are two somewhat radical solutions that the Treasury could try. One option is the Treasury could invoke the 14th Amendment, which states that the U.S. cannot default on its debt, arguing that the debt ceiling limit is unconstitutional and hence ignore it.

Alternatively, the Treasury has authority to issue collector coins and could print a $1 Trillion coin, which would give the Treasury funds to pay its bills. Both workarounds would do little to reassure investors that Congress stands behind the debt and would exacerbate the perception that our government is dysfunctional.

Hopefully we don’t end up with either of these ‘solutions’.

Wake up Voters!

The long-term effects of debt are too easily ignored by politicians when voters don’t demand progress on deficits. Compared to the fiery rhetoric that motivates today’s voters, a conversation on debt reduction excites no one. Politicians rarely face consequences for increasing debt and most want to increase spending and stimulate economic growth when voters hit the polls, helping reelection efforts.

Unfortunately, it may take a crisis for voters to realize that debt and deficits matter. Politicians need to know that voters care about the fiscal standing of their country. Most would argue that the debt ceiling limit legislation is useless, considering the limit has been raised 78 times since 1960. This time, perhaps, the game of chicken increases the public’s awareness of our debt situation and forces politicians to focus on the budgetary consequences of their legislation.

We last had a similar crisis in 2011, when an agreement was not reached until very close to the deadline. Markets temporarily sold off but recovered within the following months once the debt ceiling was raised and the “crisis” was resolved albeit at the 11th hour. If history is an example, we do not believe this should cause anyone to alter long-term investment strategies as short-term market moves are invariably hard to predict and markets can bounce back quickly.

Often it is the case that things need to break before politicians find the will to fix them. Ultimately, we view an inability to raise the debt ceiling as a very low probability but high-risk event – it should be monitored but not cause panic. While we do not believe the U.S. will default on its obligations and has ample capacity to service debs, it is likely that this game of chicken affects markets and raises short-term volatility.