Big Tech: Big Earnings

The S&P 500 constituents closed out the first quarter with strong earnings. The Q1 blended growth rate for S&P 500 companies reached 5.9%, the highest since Q1 2022 and significantly above the 3.4% analysts expected as of March 31.

Notably, when excluding the “Magnificent 7” companies, the blended earnings growth rate for the rest of the S&P 500 was -1.80%. Those 7 stocks alone swung the S&P 500 earnings by over 7%! In that context, it doesn’t seem unreasonable for the companies generating a disproportionate amount of earnings to see a disproportionate amount of affection from investors. Accordingly, in May, “Big Tech” stocks posted outsized gains relative to the rest of the market, with more than half of the S&P 500’s returns coming from NVIDIA (+27%), Apple (+13%), Microsoft (+7%) and Alphabet (+6%).

The Evolution of Trade Settlement

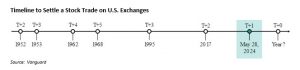

Effective May 28th, U.S. security trades shortened standard trade settlement to one business day (T+1) from two (T+2). For those unfamiliar with the term, the settlement period is the time between when a security is bought or sold and when the trade is considered final. During this window of time, the buyer must make the payment and the seller must deliver the securities.

The change received little attention from the media, however it has subtle but important ramifications for investors. To understand why, we need to look at a brief history of stock trading in the U.S.

The New York Stock Exchange began trading in 1817 with paper stock certificates which would require physical delivery for the next 150 years. In the early years, settlement could take up to 30 days. By 1952 train and airplane travel shortened settlement time to just two days (T+2). However, as overall volume of trading increased, settlement times became longer and a surge in trading in 1968 overwhelmed Wall Street with paperwork. Five business days settlement became the norm due to a shortage of couriers to transport bags of checks and stock certificates. This led to frequent Wednesday closures to settle trades.

With the advent of fax machines and the 1973 founding of the Depository Trust & Clearing Corporation (DTCC), electronic book entry transfer of securities allowed settlement periods to shorten. By 1993, the standard settlement time improved to three business days (T+3), a standard that remained for another 24 years until it dropped to two business days (T+2) in 2017. (Readers who noted the timeline above may be amused to note that it took 55 years of technological advances in processing trades to get back to the same two-day settlement period the U.S. had in 1952!)

Trading volumes continue to rise each year. To address this, securities exchanges have turned to machine learning. This technology analyzes data to identify patterns and allow most trades to settle through “straight-through” processing, where trades are executed, confirmed and settled without human intervention. As AI pushes the boundaries for the speed of crunching large amounts of data, we may eventually see trades settle on the same day.

What does a shorter settlement time mean for investors?

A shorter settlement period has three primary benefits:

- Improved capital market efficiency. Shorter settlement times result in increased liquidity, as cash is freed up more quickly post-trade. This gives investors the freedom to reinvest or spend the proceeds from their investments sooner.

- Reduced counterparty risk. Shorter settlement time reduces default risk by the other party involved in the trade, as well as the perceived risk of potential for default which can lead to actual illiquidity. A recent example of this was in 2020, where a perceived lack of liquidity in the less newsworthy investment grade bond market led to wild swings in prices. The Fed took the unusual step of announcing they were willing to buy baskets of corporate bonds and backstop municipal issuers, effectively creating an additional risk-free counterparty. Almost immediately thereafter liquidity resumed and volatility fell as investors were reassured.

- Less time for market volatility and black swan events to affect the execution of trades. Shorter settlement times reduce the likelihood of a repeat of the “short squeeze” of January 2021 which caused a rise in meme stocks of broken companies like Gamestop. While there is no quick fix for social media hype and rampant option speculation, relieving some of the forced buying by market makers will make these types of pump-and-dump strategies less profitable than they have been in the past.

Capital Markets

Major U.S. indices closed higher in May, following a weak April. The S&P 500 and Nasdaq saw five consecutive weeks of gains before declining during the last week of the month. In May, the All-Country World Index (ACWI) rose 4.3%, the S&P 500 rose 4.8%, the EAFE rose 4.1%. and U.S. small caps rose 4.9%. Emerging market lagged, rising just 0.61% as slowing growth in China led stocks lower.