Inflation has been top-of-mind for many investors and consumers this year, particularly as the economy reopens and prices for some goods have seen sharp increases from a year ago. The Bureau of Labor Statistics reported that April’s Consumer Price Index (CPI) excluding food and energy (core inflation) rose 3.0%, the largest year over year increase since 1995. The larger than expected increase spurred inflation fears across stock and bond markets. Although the negative market reaction has proved to be short lived, the spike in inflation has prompted many questions regarding the ongoing risk of inflation. While inflation, the change in prices, is a simple concept, the drivers behind inflation are complex and have changed over time. In the following, we look to answer the following questions:

- Why the sudden jump in inflation?

- Why do investors dislike inflation?

- Will higher inflation continue?

- Why has inflation for the past 20 years been low?

Why the sudden jump in inflation?

There are two main causes for the jump in inflation: 1) comparisons to a low base and 2) pandemic driven shortages. To calculate the year-over-year change, current price levels are compared to price levels a year ago during pandemic shutdowns. For example, a year ago prices for hotels and travel fell sharply during the shutdowns as few people were travelling. These prices have returned to approximately pre-pandemic levels and recorded sharp gains. So, some of the jump in core CPI is due to the comparison to prices at historic lows during the height of economic shutdowns.

In addition to these base effects, the report showed pockets of strong price gains which skewed the total increase. Prices for several items have soared as manufacturers are unable to keep up with a sharp recovery in demand. Supply chains for many items have broken due to Covid shutdowns, weather problems, shipping delays or plant slowdowns. A perfect example is used car demand where used cars prices saw a shocking 21% increase from last year. Production for new cars this year has stalled due to pandemic related plant closures and shortages in semi-conductors, a vital component for new cars. Without new cars to buy, consumers have purchased used cars and driven up prices.

The U.S. economy has been hit by a storm of factors disrupting supply chains and surges in demand exacerbated by Covid shutdowns. Changing consumer patterns, like working from home, has led to sharp increases in demand for houses, furniture, lumber, and home repair, all driving up prices just as plants were shut down due to pandemic restrictions. Also contributing to delays was the February deep freeze in Texas which led to shortages of plastics and other components and the March blockage of the Suez Canal. Shutdowns and weather disruptions such as these typically have a lagging, but temporary effect on the overall economy. Analysts believe it might take several months to over a year for some items like semiconductors to resolve the shortages.

Why do investors dislike inflation?

Bond investors typically monitor inflation gauges very closely as higher inflation erodes the purchasing power of future cash flows. Additionally, higher inflation could force the Federal Reserve (Fed) to raise interest rates to slow inflation, reducing bond returns. During this recovery, the Fed has repeatedly stated that they are comfortable running higher inflation, because there is still slack in the labor market and they believe higher inflation will be short-lived. After the higher-than-expected CPI release, yields rose slightly, but have since fallen back. For now, bond investors appear to agree with the Fed that the increase in inflation is temporary.

The impact of higher inflation on equities will vary depending upon each company’s ability to pass on higher production costs to consumers. For companies without strong pricing power, inflation could erode their margins and earnings. The broad-based market selloffs centered around inflation news appear to be a result of fading market sentiment rather than fundamental changes in earnings expectations or valuations. Since pandemic lows, equities markets have seen strong performance. With the growth of retail investors, many using Robinhood platform, speculative investments like SPACs, Bitcoin and Gamestop have soared. Recently, many of these hot investments have soured. Our view is that rising interest rates may undo some of the market froth as market sentiment changes, but fundamental valuation is not significantly changed due to recent changes in inflation.

Will higher inflation continue?

Though inflation is notoriously hard to predict, April’s CPI report does not indicate higher inflation for the long term. The CPI report did not indicate widespread pricing pressures, instead showed strong pricing gains in categories affect by shortages. For example, one third of the core inflation increase of 3.0% was due to the 21% increase in used car prices. It is unlikely these gains will be sustained. Analysts expect most of the shortages will work themselves out as the economy returns to normal.

An important part of core CPI (33% of weight) are prices for shelter, mainly rents, which were up 2.1% year over year. The level of rents are still below pre-pandemic levels, bouncing off a low base too. Part of the increase in shelter has been higher prices for hotels. Over the past decade, inflation in shelter has been low and has helped moderated CPI gains.

Perhaps the most important factor for sustained inflation is wage growth. Higher wage growth increases demand for goods and services allowing companies to increase prices. The cycle of higher wages leading to higher prices was prevalent during the inflationary periods of the 70’s. Normally, during the early stages of a recovery, wage growth is not a concern. However, the pandemic and the strong fiscal response has affected the job market creating some wage pressure. This past month job growth slowed dramatically due to a reluctancy for some pockets of workers to return to work. These include older workers, workers with health concerns and women caring for young children who have left the workforce and are not searching for a job. Also, contributing are generous unemployment benefits which can exceed more than $30,000 in annual pay in some states, creating a disincentive for workers to return to work. As a result, many small businesses are reporting difficulties finding workers and are having to pay more for low-skilled labor. Wages for hourly workers in leisure and hospitality have jumped up 5.6% above pre-pandemic levels. Despite these pay gains in hourly workers, overall wage growth has been consistent with wage growth over the past 5 years – below 3.5%. Thus far, gains in wages for lower-paid workers has not led to a similar increase in the level of overall wages for the U.S. economy. Certainly, we will continue to monitor wage growth for signs of sustained inflation.

Why has inflation for the past 20 years been low?

The U.S. economy has changed drastically since we last had sustained inflation over 20 years ago. Secular forces and trends have reduced and limited the rate of inflation and kept core CPI gains range around 2% per year.

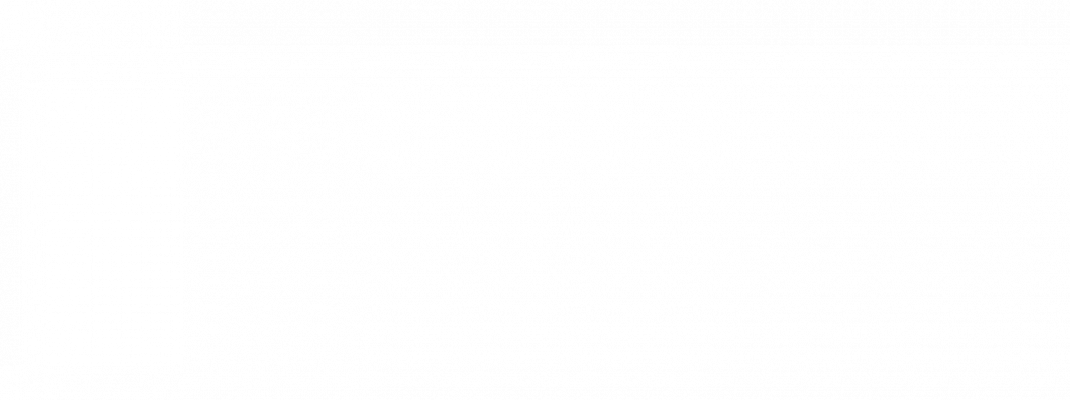

The below chart shows core the year-over-year change in CPI starting in 1975. The red lines highlight that since 1995 core CPI has been modest and mostly range bound between 1.5% and 3.0%. The chart shows that inflation prior to 1995 was significantly higher than the most recent reading of 3.0%.

- Globalization – Supply chains, outsourcing and increased competition through trade has reduced companies’ ability to raise prices, especially in manufacturing. Growth in trade with China after their inclusion in the World Trade Organization has increased these pressures. Research reports estimate that global trade factors account for over 50% of CPI changes. Globalization has helped to limit wage gains for workers especially in lower skilled jobs.

- Technology – Advancements in technology have dramatically changed the way prices flow through the economy. Online shopping has greatly enhanced price transparency and limited retailer’s pricing power. Advancements in automation have lowered companies’ production costs and reduced demand and pay for low-skilled workers. Additionally, economists have argued that all the benefits of technology have not been fully captured in CPI data, suggesting that reported CPI is higher than it should be. For example, CPI data does not include free services like Facebook and Google search which are used daily by millions of people.

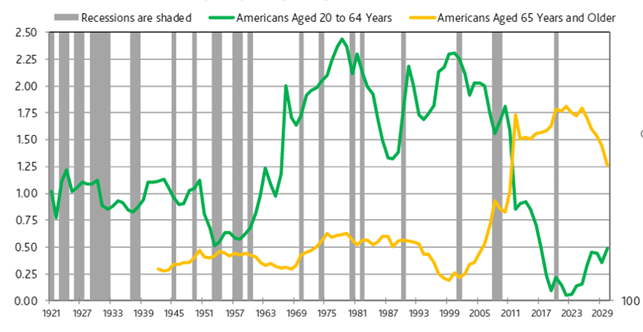

- Demographics – As baby boomers age, growth in working age adults has fallen to close to zero, while growth in Americans aged 65 or older has spiked 3.8% per year. Overall, the percentage of adults over 65 has growth from 11.5% of the U.S. population in 1980 to over 16% today. This demographic shift reduces demand for goods in the U.S. as baby boomers retire, earn, and spend less. Reduced growth in working age populations will reduce overall economic growth. The below chart shows population growth for working age adults and adults 65 and older.

Source: Moody’s Analytics

Secular changes brought on by globalization, technology and demographics have not gone away since the pandemic and will continue to reduce pricing gains. These forces support our belief that recent spikes in inflation will be transitory.

Conclusion

While the recent higher rate of inflation is above the Fed’s target and may continue for several months, we believe the increase in CPI is transitory and will moderate once shortages are resolved and easy year-over-year comparisons are behind us. Overall wage growth remains benign despite pay gains in low-skilled workers. Further, the secular forces of globalization, technology and demographics will continue to limit gains in wages and prices. Knowing that inflation is hard to predict, we will continue to monitor wage growth and changes in pricing behavior beyond pockets like used cars. We continue to focus our investments on high quality businesses that have pricing power to grow their top line revenue and cash flow to protect their long-term value.