https://www.youtube.com/watch?v=9HetS5l4d_A

Crestwood Advisors Breaks Down Common Questions About Inflation

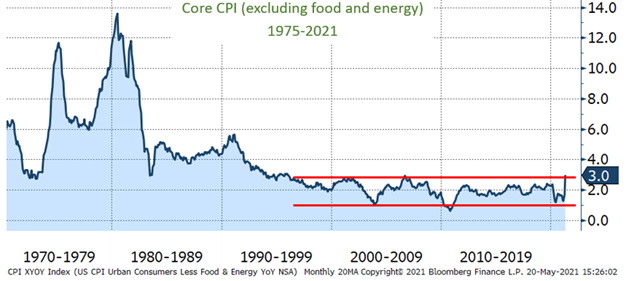

Inflation has been top-of-mind for many investors and consumers this year, particularly as the economy reopens and prices for some goods have seen sharp increases from a year ago. The Bureau of Labor Statistics reported that April’s Consumer Price Index (CPI) excluding food and energy (core inflation) rose 3.0%, the largest year over year increase since 1995. The larger than expected increase spurred inflation fears across stock and bond markets. Although the negative market reaction has proved to be short lived, the spike in inflation has prompted many questions regarding the ongoing risk of inflation. While inflation, the change in prices, is a simple concept, the drivers behind inflation are complex and have changed over time. In the following, we look to answer the following questions:

- Why the sudden jump in inflation?

- Why do investors dislike inflation?

- Will higher inflation continue?

- Why has inflation for the past 20 years been low?

Why the sudden jump in inflation?

There are two main causes for the jump in inflation: 1) comparisons to a low base and 2) pandemic driven shortages. To calculate the year-over-year change, current price levels are compared to price levels a year ago during pandemic shutdowns. For example, a year ago prices for hotels and travel fell sharply during the shutdowns as few people were travelling. These prices have returned to approximately pre-pandemic levels and recorded sharp gains. So, some of the jump in core CPI is due to the comparison to prices at historic lows during the height of economic shutdowns.

In addition to these base effects, the report showed pockets of strong price gains which skewed the total increase. Prices for several items have soared as manufacturers are unable to keep up with a sharp recovery in demand. Supply chains for many items have broken due to Covid shutdowns, weather problems, shipping delays or plant slowdowns. A perfect example is used car demand where used cars prices saw a shocking 21% increase from last year. Production for new cars this year has stalled due to pandemic related plant closures and shortages in semi-conductors, a vital component for new cars. Without new cars to buy, consumers have purchased used cars and driven up prices.

The U.S. economy has been hit by a storm of factors disrupting supply chains and surges in demand exacerbated by Covid shutdowns. Changing consumer patterns, like working from home, has led to sharp increases in demand for houses, furniture, lumber, and home repair, all driving up prices just as plants were shut down due to pandemic restrictions. Also contributing to delays was the February deep freeze in Texas which led to shortages of plastics and other components and the March blockage of the Suez Canal. Shutdowns and weather disruptions such as these typically have a lagging, but temporary effect on the overall economy. Analysts believe it might take several months to over a year for some items like semiconductors to resolve the shortages.

Why do investors dislike inflation?

Bond investors typically monitor inflation gauges very closely as higher inflation erodes the purchasing power of future cash flows. Additionally, higher inflation could force the Federal Reserve (Fed) to raise interest rates to slow inflation, reducing bond returns. During this recovery, the Fed has repeatedly stated that they are comfortable running higher inflation, because there is still slack in the labor market and they believe higher inflation will be short-lived. After the higher-than-expected CPI release, yields rose slightly, but have since fallen back. For now, bond investors appear to agree with the Fed that the increase in inflation is temporary.

The impact of higher inflation on equities will vary depending upon each company’s ability to pass on higher production costs to consumers. For companies without strong pricing power, inflation could erode their margins and earnings. The broad-based market selloffs centered around inflation news appear to be a result of fading market sentiment rather than fundamental changes in earnings expectations or valuations. Since pandemic lows, equities markets have seen strong performance. With the growth of retail investors, many using Robinhood platform, speculative investments like SPACs, Bitcoin and Gamestop have soared. Recently, many of these hot investments have soured. Our view is that rising interest rates may undo some of the market froth as market sentiment changes, but fundamental valuation is not significantly changed due to recent changes in inflation.

Will higher inflation continue?

Though inflation is notoriously hard to predict, April’s CPI report does not indicate higher inflation for the long term. The CPI report did not indicate widespread pricing pressures, instead showed strong pricing gains in categories affect by shortages. For example, one third of the core inflation increase of 3.0% was due to the 21% increase in used car prices. It is unlikely these gains will be sustained. Analysts expect most of the shortages will work themselves out as the economy returns to normal.

An important part of core CPI (33% of weight) are prices for shelter, mainly rents, which were up 2.1% year over year. The level of rents are still below pre-pandemic levels, bouncing off a low base too. Part of the increase in shelter has been higher prices for hotels. Over the past decade, inflation in shelter has been low and has helped moderated CPI gains.

Perhaps the most important factor for sustained inflation is wage growth. Higher wage growth increases demand for goods and services allowing companies to increase prices. The cycle of higher wages leading to higher prices was prevalent during the inflationary periods of the 70’s. Normally, during the early stages of a recovery, wage growth is not a concern. However, the pandemic and the strong fiscal response has affected the job market creating some wage pressure. This past month job growth slowed dramatically due to a reluctancy for some pockets of workers to return to work. These include older workers, workers with health concerns and women caring for young children who have left the workforce and are not searching for a job. Also, contributing are generous unemployment benefits which can exceed more than $30,000 in annual pay in some states, creating a disincentive for workers to return to work. As a result, many small businesses are reporting difficulties finding workers and are having to pay more for low-skilled labor. Wages for hourly workers in leisure and hospitality have jumped up 5.6% above pre-pandemic levels. Despite these pay gains in hourly workers, overall wage growth has been consistent with wage growth over the past 5 years – below 3.5%. Thus far, gains in wages for lower-paid workers has not led to a similar increase in the level of overall wages for the U.S. economy. Certainly, we will continue to monitor wage growth for signs of sustained inflation.

Why has inflation for the past 20 years been low?

The U.S. economy has changed drastically since we last had sustained inflation over 20 years ago. Secular forces and trends have reduced and limited the rate of inflation and kept core CPI gains range around 2% per year.

The below chart shows core the year-over-year change in CPI starting in 1975. The red lines highlight that since 1995 core CPI has been modest and mostly range bound between 1.5% and 3.0%. The chart shows that inflation prior to 1995 was significantly higher than the most recent reading of 3.0%.

- Globalization – Supply chains, outsourcing and increased competition through trade has reduced companies’ ability to raise prices, especially in manufacturing. Growth in trade with China after their inclusion in the World Trade Organization has increased these pressures. Research reports estimate that global trade factors account for over 50% of CPI changes. Globalization has helped to limit wage gains for workers especially in lower skilled jobs.

- Technology – Advancements in technology have dramatically changed the way prices flow through the economy. Online shopping has greatly enhanced price transparency and limited retailer’s pricing power. Advancements in automation have lowered companies’ production costs and reduced demand and pay for low-skilled workers. Additionally, economists have argued that all the benefits of technology have not been fully captured in CPI data, suggesting that reported CPI is higher than it should be. For example, CPI data does not include free services like Facebook and Google search which are used daily by millions of people.

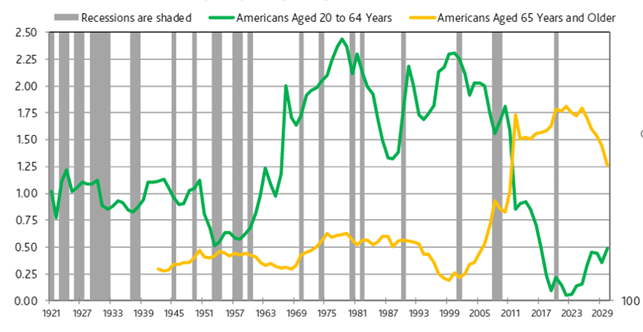

- Demographics – As baby boomers age, growth in working age adults has fallen to close to zero, while growth in Americans aged 65 or older has spiked 3.8% per year. Overall, the percentage of adults over 65 has growth from 11.5% of the U.S. population in 1980 to over 16% today. This demographic shift reduces demand for goods in the U.S. as baby boomers retire, earn, and spend less. Reduced growth in working age populations will reduce overall economic growth. The below chart shows population growth for working age adults and adults 65 and older.

Source: Moody’s Analytics

Secular changes brought on by globalization, technology and demographics have not gone away since the pandemic and will continue to reduce pricing gains. These forces support our belief that recent spikes in inflation will be transitory.

Conclusion

While the recent higher rate of inflation is above the Fed’s target and may continue for several months, we believe the increase in CPI is transitory and will moderate once shortages are resolved and easy year-over-year comparisons are behind us. Overall wage growth remains benign despite pay gains in low-skilled workers. Further, the secular forces of globalization, technology and demographics will continue to limit gains in wages and prices. Knowing that inflation is hard to predict, we will continue to monitor wage growth and changes in pricing behavior beyond pockets like used cars. We continue to focus our investments on high quality businesses that have pricing power to grow their top line revenue and cash flow to protect their long-term value.

Crestwood Advisors Expands Team by 25% During Pandemic, AUM Has Doubled in Two Years

FOR IMMEDIATE RELEASE:

Boutique RIA firm experiences continued growth with additional hires in Darien and Boston offices, outlines future expansion goals

Boston, Mass. (April 12, 2021) – Crestwood Advisors (“Crestwood”), a boutique investment advisory and wealth management firm based in Boston, today announced it has eclipsed two key milestones in its strategic growth plan.

In two years’ time, Crestwood has more than doubled its assets under management. During the pandemic, the firm has also expanded its team by 25% to support growing client needs.

The newest team additions include Charles W. Tricomi Jr., Hillary Urbancic-Davis and Nathan Gore.

Charles W. Tricomi, Jr., CFA, CFP® | Charles joins Crestwood as a Portfolio Manager, working out of its Darien, Connecticut office. He brings CFA & CFP® designations as well as 7+ years of wealth management experience to his role.

Hillary Urbancic-Davis, CPWA® | Hillary joins Crestwood at its headquarters as a Client Advisor. She possesses 7 years of direct client engagement experience with high-net-worth families. She holds a CPWA designation and is pursuing a CIMA designation.

Nathan Gore | Nathan joins Crestwood at its headquarters as an in-house Technology Specialist. He is a Certified Salesforce Administrator and brings a vast technical background to his role at the firm.

Committed to holding itself to a standard of fiduciary excellence, these strategic additions will aid Crestwood in its mission of developing client strategies that seek to protect, preserve and grow wealth. Now equipped with a team of 41 financial planning and investment professionals across its three offices, Crestwood has hired eight people over the past year.

“We’re thrilled to see our team growing and thriving,” said Crestwood CEO/Managing Partner Michael Eckton. “As we continue stewarding the most advantageous financial solutions for our clients through the growth of our staff, we’re also setting our sights on market growth, with a focus on enhancing Crestwood’s footprint in the Connecticut region and across the New England region.”

In 2019, Crestwood merged with Westport-based Catamount Wealth Management and MacGuire, Cheswick & Tuttle Investment Counsel in Darien to expand its footprint into Connecticut and broaden its team.

The mergers have helped the firm grow to three offices that now manage approximately $4.17 billion in assets, as of March 31, on behalf of high-net-worth individuals and families. Two years ago, Crestwood had approximately $1.99 billion in assets under management.

Crestwood continues to experience increased client growth and greater demand for more holistic financial planning services and investment strategies, which could fuel additional staffing needs.

“We’re optimistic about the significant progress we’ve made over the past two years, and hope to continue in this direction by attracting talent organically and acquiring it,” Eckton said.

Crestwood’s executive team remains active in its recruiting efforts of wealth management professionals from New York to Maine, including financial planners and portfolio managers, to further enhance client support and achieve results that meet current and future objectives.

Crestwood whitepaper on Antitrust & Big Tech

Crestwood Webinar Series – Assessment of the Post-Election Climate & Its Implications

Crestwood Fosters Talent Expansion – From A Distance

FOR IMMEDIATE RELEASE

Remote work success allows firm to continue along growth trajectory

Boston, Mass. (January 21, 2021) – Crestwood Advisors (“Crestwood”), a boutique investment and wealth management firm with offices in Massachusetts and Connecticut, today announced recent additions to its team of financial professionals and expansion plans for 2021.

Since switching to a remote work model in 2020, Crestwood has made five hires, including four at the end of the fourth quarter.

The latest team additions include:

- Greg McSweeney, CFA, Portfolio Manager

- Tiffany So, Client Advisor

- Nicholas Dipoto, Operations Specialist

- Joseph Bruno, Client Services Associate

- Olivia Godin, Client Advisor

“When the pandemic began, we weren’t sure how going virtual would impact team expansion, but we adapted quickly and it has worked in our favor as there has been a dramatic uptick in financial professionals who are looking for added flexibility, including remote work options,” said Crestwood CEO/Managing Partner Michael Eckton.

“Dynamic firms like Crestwood, who have embraced technology and the flexible work environment that will likely remain in place, may continue to have a competitive advantage in the recruitment and retention of employees,” Eckton added. “We’re thrilled to welcome our new teammates to add depth and expand client engagement in 2021.”

Increasing demands from high-net-worth individuals and families for comprehensive financial planning services and investment strategies has allowed Crestwood to continue growing. With its recent additions, the firm has surpassed 40 employees across three regional offices.

Crestwood leaders remain active in their remote recruiting efforts of wealth management professionals, including financial planners and portfolio managers to further enhance client support and achieve results that meet their current and future growth objectives.

About Crestwood Advisors

Crestwood Advisors is an independent, fee-only, wealth management firm with approximately $4 billion in assets under management. Founded in 2003, Crestwood Advisors provides investment management with financial planning strategies to help high-net-worth individuals and families identify and prioritize their goals and build sustainable wealth so that they may enjoy more financially secure and purposeful lives. For more information, please visit https://www.crestwoodadvisors.com.

Crestwood CEO Joins Lenny Zakim Fund Board of Directors

FOR IMMEDIATE RELEASE

Eckton looks to help Boston-based grassroots organization advance mission with further involvement

Boston, Mass. (January 4, 2021) – Crestwood Advisors (“Crestwood”), a boutique investment and wealth management firm based in Boston, today announced that CEO and Managing Partner Michael Eckton has joined the Lenny Zakim Fund (“LZF”) board of directors.

Eckton will serve an initial three-year term on the board of the Boston-based nonprofit organization. Having supported the Lenny Zakim Fund on a personal level for more than a decade, Eckton asserts his involvement stemmed from his strong belief in the organization’s mission of achieving social, racial and economic justice for all.

Over the past 10 years, Eckton has served as a site visitor, bridge builder and volunteer on internal committees with LZF, including those tasked with allocating funds to grantees.

“For 25 years, the Lenny Zakim Fund has played a vital role in grant making to address the countless needs in our local communities, and I’m honored to play a small part in encouraging and highlighting the ongoing work being done by LZF and its leadership team,” Eckton said. “I’m committed to doing my part to uplift our grassroots community organizations who are forever challenged and especially struggling under the current circumstances.”

Supporting the community is also a central part of Crestwood Advisors’ mission. Under Eckton’s leadership, the firm embraces the opportunity and responsibility to support the communities in which its team works and lives through leadership, volunteer or financial contributions.

“Joining the board of the Lenny Zakim Fund is a wonderful opportunity to help continue acknowledgment and support of social issues, and directly help disadvantaged populations,” Eckton said.

The Rise in Fraudulent Unemployment Claims

The COVID-19 pandemic has drastically changed many aspects of our lifestyles this year. The uniqueness of the pandemic has also created new avenues for scammers to launch sophisticated attacks against our personal information. One of the most common scams that has been borne out of the COVID-19 pandemic is theft of an individual’s unemployment benefits. These falsified claims may present themselves in different ways. If you are self-employed or retired, you may receive a letter in the mail from your local Unemployment Agency outlining your unemployment benefits claim. If you are employed, your HR department will contact you if a claim is filed with them on your behalf.

To file an unemployment claim in your name, a scammer must have access to personal information, like your social security number and date of birth. Below, we have outlined steps that can be taken should you receive a notice of a fraudulent unemployment claim, proactive measures to better protect your identity against attempted fraud and actions that Crestwood takes to keep your data safe.

What to Do If a Fraudulent Unemployment Claim Has Been Filed on Your Behalf

- Utilize the Department of Unemployment Assistance fraud contact form at https://www.mass.gov/info-details/report-unemployment-benefits-fraud or call the DUA customer service department at 877-626-6800.

- If you are not a MA resident, contact your state unemployment agency either by phone or an online platform.

- Alert your employer, your accountant, and your financial advisor, if applicable.

- Each entity will take precautionary measures to safeguard your identity and your assets further.

- Make a list of credit card companies, banks, and other financial institutions where you do business. Notify them that you are a potential victim of identity theft and ask them to put a fraud alert on your account.

- Get a copy of your credit report by contacting the Federal Trade Commission either at https://identitytheft.gov/ or 877-ID-THEFT.

- File a complaint with the FTC to ensure that any fraudulent transactions are disputed, fraudulent accounts in your name are closed, and to place an alert on your account.

- Contact the 3 major credit bureaus and request a credit freeze.

- Equifax: 800-349-9960 or online

- Experian: 888 397 3742 or online

- TransUnion: 888-909-8872 or online

- File a police report with your local police department. Get a copy of the report that you can provide to creditors and credit agencies.

- Update passwords to all entities that house potentially sensitive data.

Proactive Measures to Protect Your Identity Further

- Change passwords on your email, banking, and other personal accounts more than once a year.

- Use dual authentication, where available, and a password management tool to create and house strong, unique passwords.

- Set up your My Social Security account.

- Visit https://secure.ssa.gov/RIL/SiView.action to set up your account and prevent someone else from potentially doing so in your name.

- Review your credit card, bank and investment statements in detail on a regular basis.

What Crestwood Advisors is Doing to Keep Your Data Safe

- We employ dual authentication on our systems and with our custodians

- We are committed to utilizing added layers of authentication such as verbal authorization prior to any 3rd party money movement.

- We work diligently to protect your personal information through employee training and email encryption.

- Should you fall victim to any instance of fraud, we will work with our custodians to freeze your account(s) to protect the assets.

If you have questions about fraudulent unemployment claims or believe you are a victim of identity theft, please do not hesitate to contact your team at Crestwood Advisors.

Crestwood Webinar Series – Roth IRA Conversations

Michael Eckton on NBC News

Please click the link below to read the new article in which Michael Eckton was quoted on the broader US equity markets.

“S&P 500 hits new record high – but a reckoning could be on the way”