A report from the Bureau of Labor Statistics (BLS) released after July’s FOMC meeting showed weaker job growth in the May-July period than previously estimated. Job growth for June and July was significantly revised downward, with 258,000 fewer reported new jobs. The labor market is feeling the pressures of broad uncertainty, higher tariffs, and reduced immigration.

The reaction was swift: President Trump fired the head of the BLS, the dollar weakened, and equity markets reacted poorly to both the numbers and the firing.

As we have noted in prior Economic Updates, data gathering is a slow process and subject to frequent revision. Further, Fed Governor Waller noted in a speech on July 17 that there was a likelihood of downward revisions when the data was released1. So, for those closely listening to the Fed, the BLS announcement was not completely out of the blue.

Importantly, while the disappointing job growth numbers show that economic activity is slowing, the data also support the case that the job market is still generally healthy. The weaker data increases the odds that the Fed cuts interest rates during its next meeting on September 17.

Divergence of Opinions at the FOMC

At its July 30 meeting, the Federal Open Market Committee (FOMC) opted to hold the federal funds rate at 4.25% – 4.50% for the fifth consecutive session. The recurring theme behind the Fed’s decision to leave rates unchanged has been persistent uncertainty.

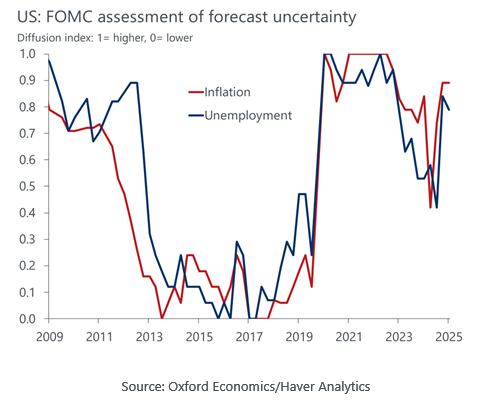

The FOMC Diffusion Index (shown below) captures the distribution of individual FOMC participants’ judgments about economic forecasts like GDP, inflation or unemployment. The chart shows that index levels have risen significantly this year. In fact, they are reaching points not seen since the period surrounding the Pandemic or the years following the Great Financial Crisis of 2008.

In the current environment, it’s not surprising that the decision of the FOMC this time was not unanimous. While individual dissents among Fed governors and presidents of the various Federal Reserve banks are not uncommon, July’s meeting marked the first time since 1993 that two governors dissented from the majority decision. Who dissented is worth noting: Michelle Bowman and Christopher Waller both favored a rate cut now. Their premise was that inflationary pressure from tariffs will be temporary and that risks to employment warrant a cut sooner rather than later.

Readers will note that Waller had signaled his pending dissent weeks in advance in the speech noted above, and Bowman was among the potential candidates to succeed Powell as the next Fed Chair. Their opinions may be foreshadowing the direction of the next iteration of the Fed.

September will be eventful for several reasons:

- President Trump has nominated Stephen Miran, often credited as the chief architect of the administration’s tariff policy, to fill the vacancy left by Fed Governor Adriana Kugler’s August departure. In 2024, Miran co-wrote a paper 2 critical of the Fed and argued that governance should be overhauled. Among the recommendations were giving the President the power to remove Fed board members and Reserve Bank leaders at will2. The Senate Banking Committee will hold hearings on Miran’s nomination, which will include questioning him about his qualifications, policy positions, and perspective on the role of the Fed.

- The Fed will have several more months of labor market and inflation data to contextualize the effect of tariffs and immigration policy on the US economy.

- The FOMC will release an updated Statement of Economic Projections (aka, their “Dot Plot”), which captures the Fed members’ estimates for the range of interest rates over the next few years.

What does this mean for investors?

Investors should continue to expect further economic impact from an evolving tariff policy and reduced immigration as well as deportations. Although their impact on prices and growth can be slow to manifest, their effects inevitably show in data such as the labor market report. Investors should anticipate this and not be taken off guard when data appears to ‘surprise’ the market by showing evidence of this. As always, patience and discipline are the best approaches.

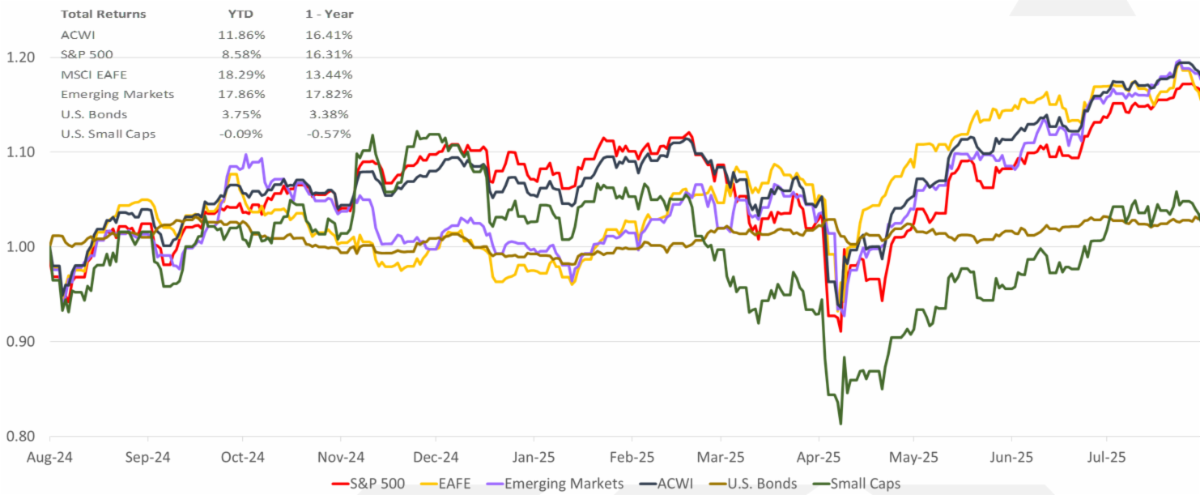

Capital Markets

The MSCI All Country World Index (ACWI) rose 1.4% in July. The S&P 500 rose for a third straight month returning 2.2%. The Index is now up 8.6% year-to-date after being down as much as 15% in early April. Developed International equities (MSCI EAFE) weakened, losing 1.4% for the month, while Emerging Markets rose by 2%. US Small and Mid Caps (Russell 2000) rose 1.7%, while bonds were flat.

Source: Bloomberg. EAFE is MSCI EAFE Index(1), Emerging Markets is MSCI Emerging Markets(2) and U.S. Bonds is Barclays U.S. Aggregate(3). ACWI is the MSCI ACWI Index(4). Small Caps is the Russell 2000 Index(5). S&P 500 is the S&P 500 Index(6). The S&P 500 Ex-NVDA/ AVGO represents the S&P 500 excluding the stocks Nvidia and Broadcom, the remaining stocks are then weighted by their market cap. The above information is as of 7/31/2025.

Footnotes:

1: The Case for Cutting Now by Governor Christopher Waller. Full text available at: https://www.federalreserve.gov/newsevents/speech/waller20250717a.htm

2: Reform the Federal Reserve’s Governance to Deliver Better Monetary Outcomes by Dan Katz, Stephen Miran. Full text available at: https://manhattan.institute/article/reform-the-federal-reserves-governance-to-deliver-better-monetary-outcomes

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.