It can be difficult to navigate the complexities of financial management when you’re just starting your career, especially when you live in a high-cost area. Making thoughtful financial decisions early on can support greater flexibility and security down the road. The three foundational lessons below can help lay the groundwork for financial resilience and long-term confidence.

“Expecting the unexpected is not just a mindset; it’s a passport to the thrilling destinations of life’s journey.” — Simon Sinek

Life is full of surprises. Building an emergency fund is a key first step in financial planning. Aim to set aside 3-6 months of essential living expenses in a high-yield savings or money market account. This fund should serve as a safety net in the event of job loss, medical bills, or other unexpected circumstances life may throw your way, and helps you avoid relying on high-interest debt or personal loans. Start by contributing a small, consistent amount each month, and increase contributions as your income grows. Revisit the fund annually or after major life changes, such as a move, a new job, or increased living costs, to ensure it remains appropriately sized for your needs.

“Someone is sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffet

Look ahead to the life you want and prioritize investing early so there will be adequate financial resources available to help you realize your long term goals. While it can be tempting to focus on short-term spending, building lasting financial security starts with discipline and consistently “paying yourself first” by allocating a portion of your income toward your savings. Crestwood can help you understand the fundamentals of saving and investing.

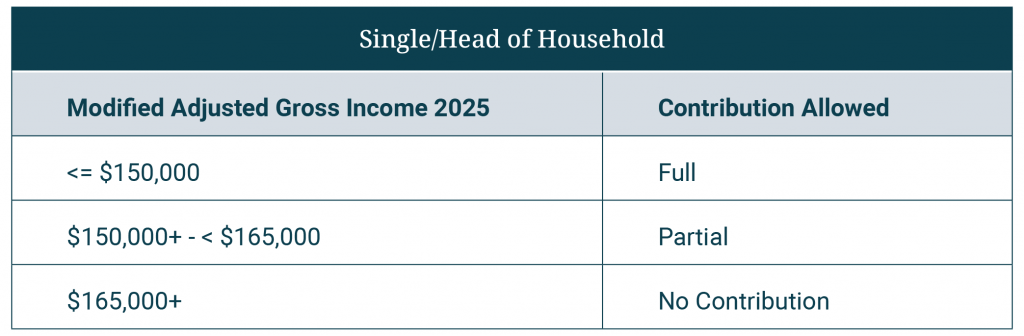

It’s also a good idea to contribute to a Roth IRA early in your career, before your income exceeds the limit, because Roth IRAs offer valuable tax advantages. Since the money you contribute has already been taxed, you are not taxed on qualified withdrawals in retirement, and you will not be required to make withdrawals from that account. If you are younger than 50 years old, you can contribute up to $7,000 into a Roth IRA in 2025, but only if your modified adjusted gross income is below the cut-off.

In addition, try to participate in your company’s 401(k) plan, making sure to contribute enough to take advantage of any available employer match. Some employers will match your savings, fully or partially, up to a designated percentage. This is essentially free money toward your retirement. A common rule of thumb is to save approximately 10% – 15% of your salary for retirement, including a match from your employer. However, be sure to understand the vesting schedule on matched funds, which may require you to stay employed for a certain number of years before the company’s contributions fully belong to you.

“Real change, enduring change, happens one step at a time.” — Ruth Bader Ginsburg

Actively managing your career development and creating a financial plan for the future can help put the odds in your favor. In your career, continue to diversify your experience and develop transferable skills such as writing, analytics, and project management. In addition, leverage employer-sponsored development programs and network internally and externally to build connections that expand your options.

Reach Out to Crestwood

We help clients and their families make sound decisions for the future and protect wealth through every life stage. If you or a loved one is just starting out, we would be happy to have a conversation to help them build a plan tailored to their goals.

If you are not yet a Crestwood client, please contact us to see how we can help you and your loved ones realize their dreams.

This document is provided for general informational purposes only by Crestwood Advisors, an investment adviser. Crestwood Advisors does not provide legal advice, and this document should not be construed as containing legal advice. For legal advice, consult with a licensed attorney. This document should not be construed as containing tax advice. For tax advice, consult with your tax adviser.