The Federal Reserve meets next week, and once again, it faces a mixed economic picture.

On an encouraging note, inflation appears to be stabilizing. The latest Producer Price Index (PPI) fell 0.1% in August after a 0.7% increase in July.4 The Atlanta Fed’s GDPNow model is forecasting a healthy 3.1% growth rate for the third quarter.3

However, recent downward revisions to employment data and slower job growth suggest the economy may be cooling more than previously thought. The Fed’s challenge remains the same: striking the right balance between keeping inflation in check and supporting continued growth.

The prospect of one, possibly two, new Federal Reserve members has prompted a wave of questions about the Fed’s structure and decision-making process. This month, we will cover a few of the most common questions, as well as highlight what we are watching for at the next Fed meeting.

Q: How often does the Federal Open Market Committee (FOMC) meet?

A: The FOMC has eight regularly scheduled meetings per year where they share their review of financial and economic conditions and discuss the target for monetary policy in the context of their dual mandate of price stability and maximum employment.

Q: Who votes at the FOMC?

A: The FOMC has 12 voting members: the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the eleven other Reserve Bank presidents.

The four voting Reserve Bank presidents serve on rotating one-year terms, with seats filled from the following four groups with one president from each group:

- Boston, Philadelphia, and Richmond

- Cleveland and Chicago

- Atlanta, St. Louis, and Dallas

- Minneapolis, Kansas City, and San Francisco

Non-voting Reserve Bank presidents still attend the FOMC meetings and weigh in on discussions, even though they don’t have a vote.

Q: What happens when there is a Board vacancy?

A: The process begins with the President nominating a candidate. These nominations are expected to provide a “fair representation of the financial, agriculture, industrial, and commercial interests and geographical divisions of the country.”1. Importantly, no two Governors may come from the same Federal Reserve District. Board membership is intended to reflect the various economic interests across the entire country.

A candidate must then undergo a thorough background check and submit financial and ethics disclosures. Next comes the Senate Banking Committee’s confirmation hearing, where the nominee shares their views on economic policy. If the Senate Banking Committee votes to move the nomination forward, it goes to the full Senate for debate and a final vote. Once confirmed, the nominee is sworn in and begins their term.

Governors serve a term of 14 years and appointments are staggered so that one term expires on January 31st of each even-numbered year. Once a Governor has served 14 years, they may not be re-appointed, however a Governor who served a shorter term could be re-appointed at a later date to serve up to the full 14-year term.

Once appointed, Fed Governors may not be removed based on their policy views. The staggered, lengthy terms are intended to help insulate the Federal Reserve system from day-to-day political pressures.

Q: What happens at the end of Chair Jerome Powell’s term?

A: Powell’s term as Chair of the Federal Reserve ends in May 2026. If he is not reappointed at that time, the President will nominate a new Chair from among the seven members of the Board of Governors, who will then be confirmed by the Senate for a four-year term.

Powell is eligible to remain a part of the Board of Governors until his term ends in January 2028.

Q: What are you watching at this upcoming meeting?

A: We are watching four areas:

- The interest rate decision. A 0.25% rate cut is widely expected due to the declining inflation trend and weakening labor data. A larger cut would suggest the FOMC views economic conditions to be weaker than expected, while keeping rates unchanged would suggest they are concerned that inflation may reverse course.

- Forward Guidance. The FOMC updates its Statement of Economic Projections (SEP), commonly referred to as the “Dot Plot”, four times a year. The SEP outlines where individual Fed members expect inflation and interest rates to trend over the coming quarters. When the dots cluster closely around certain levels, it suggests a consensus view; when they are more widely dispersed, it reflects significant differences of opinion among policymakers. Investors watch the Dot Plot closely for insight into the Fed’s future policy path and interest rate expectations, which in turn influence everything from bond yields to equity valuations.

- Inflation and Labor Market Data. The Fed will build an outlook by drawing on a wide range of economic data and indicators. While precise forecasting is never possible, identifying consistent patterns across multiple data points can reveal underlying trends that might be overlooked when focusing on any single metric in isolation .

- Dissent! The FOMC member opinions often have a high degree of consensus as, ultimately, they are all reviewing the same set of information from slightly different perspectives. Thus, outlier views can help highlight data points which are otherwise easily missed. For instance, as we noted in last month’s Economic Update2, Fed Governor Waller had opined weeks in advance the July meeting that there was a high likelihood of downward revisions in the labor market. This was long before the Bureau of Labor Statistics (BLS) disclosed that from March 2024 to March 2025, 911,000 fewer jobs were created than previously estimated. Both Bowman and Waller dissented from the decision at the last meeting to hold rates steady, favoring a rate cut sooner. We will be watching to see if they push for a larger cut or align with the likely consensus for a 0.25% reduction as this could signal an increasing appetite to cut further and/or faster.

Capital Markets

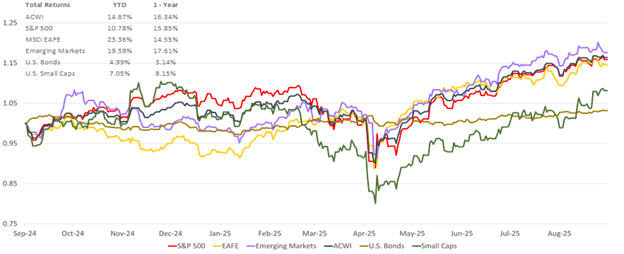

Equity markets rose broadly in August. The All Country World Index (ACWI) climbed 2.5%. The S&P 500 rose 2%. International Developed stocks, as measured by the EAFE, increased by 4.3%. Emerging Market equities (MSCI Emerging Markets Index) rose by 1.5%. US Small Cap equities, measured by the Russell 2000, lead the way with a rise of 7.1%, likely the result of a highly anticipated Fed rate cut in September. US bond prices rose 1.2% for the month.

1: Board of Governors of the Federal Reserve System. March 28, 2017. America’s Central Bank: The History and Structure of the Federal Reserve. Speech by Governor Powell on America’s central bank: the history and structure of the Federal Reserve – Federal Reserve Board

2: Crestwood August 2025 Economic Update: Shooting the Messenger and the Shifting Fed

3: Federal Reserve Bank of Atlanta. GDPNow. GDPNow – Federal Reserve Bank of Atlanta

4: U.S. Bureau of Labor Statistics. Economic New Release – Producer Price Index News Release summary. Producer Price Index News Release summary – 2025 M08 Results

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.