Even for those who do not believe in traditional New Year’s resolutions, the start of a new year naturally brings a sense of renewal. It is a moment that invites reflection and encourages us to think about how we want our lives to look and feel in the months ahead.

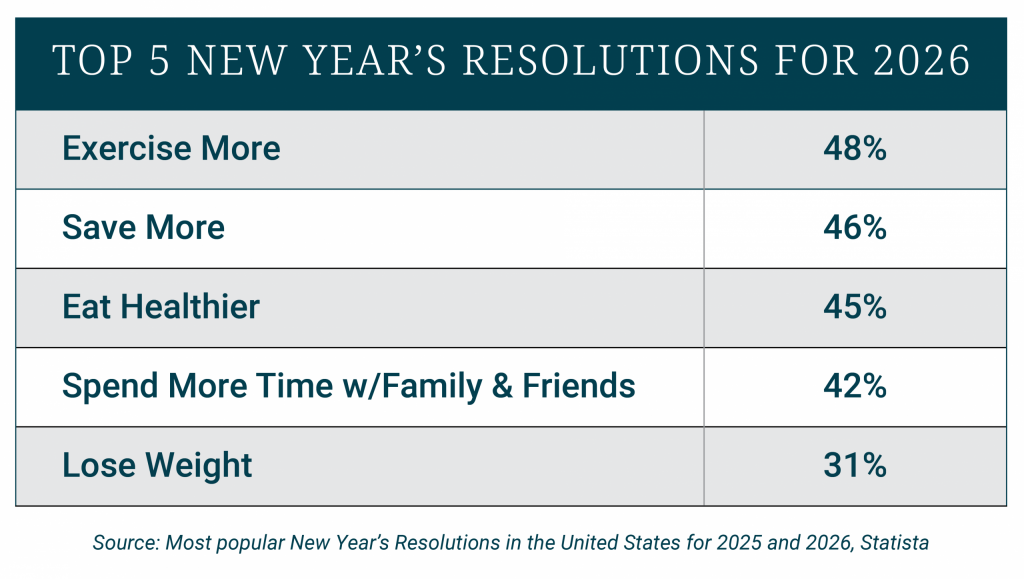

Most people focus on improving their physical, financial, and/or emotional well-being. And yet, just a few weeks into January, many give up.

How can you continue following through once the initial excitement fades? Lasting change rarely comes from willpower alone. It is built on clarity, structure, and support. Making and maintaining resolutions is much like setting and achieving financial goals, an approach we understand well at Crestwood Advisors.

Here are five strategies that can help you stick with your plan.

- Start with your reasons why. Whether you want to run a marathon, increase your charitable giving, or get together more frequently with family and friends, your reasons “why” will provide inspiration. Achieving a bucket list goal that improves your health, making a positive difference in the world, and deepening relationships with the people you care about most are reasons to stay motivated and move forward with confidence.

- Set specific, measurable, and achievable goals. Instead of simply saying you want to get fit, lose weight, or pivot in your career, set achievable goals that keep you accountable. For example, commit to walking a set number of miles each week, tracking your carbohydrate intake, or making a designated number of networking calls each day. Focus on actions you can count and control.

- Put it in writing. Just as your wealth plan guides your financial goals, writing down your personal goals can give you clarity and direction. Whether through a vision board, a simple checklist, or reminders on your phone, outlining and tracking your goals can help keep you moving forward.

- Take small steps in the right direction. Significant goals can feel overwhelming. You can’t train for a marathon or save for retirement in a day. Establishing a regimen that builds momentum, like a diversified investment strategy and a customized “Wealth Roadmap” from Crestwood, can help put you on the road to long-term success.

- Surround yourself with support. It can be difficult to navigate a journey of change on your own. Surround yourself with a collaborative team dedicated to helping you succeed. Your Crestwood team is there to support you every step of the way!

Your goals are important to you, so they’re important to us! Don’t hesitate to contact your Crestwood team for guidance when you’re resolving to change.

If you are not yet a Crestwood client, please contact us. We are here to help.

This document is provided for general informational purposes only by Crestwood Advisors, an investment adviser. Crestwood Advisors does not endorse, sponsor, or promote any of the products or companies listed or mentioned in this material. Any references to specific products or services are purely incidental and are included solely to illustrate potential strategies or concepts. The inclusion of such references does not imply any form of partnership, relationship, or approval by the Firm.