The May 1st Fed meeting concluded with no change to the policy rate, which remains at 5.25-5.5%. Prior to the meeting, there was some concern the Fed might shift its stance after recent data suggested inflation ticked up slightly and Fed Governor Bowman indicated higher rates were a possibility.

However, Powell made a point of saying that he doesn’t believe the next policy rate move will be a hike and that he expects the Fed to gain confidence in a cut based on expectations of further disinflation and a more balanced labor market. The net result was a continuation of the Fed’s “watch and wait” posture.

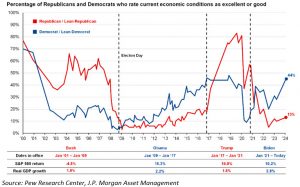

How Political Leanings Skew Perception of the Economy

As we have noted in other recent Monthly Economic Updates, investors often perceive the health of the economy based on political affiliation. The onslaught of disinformation, AI-generated content, and click-bait skews people’s biases even further.

As shown in the chart below, a recent update of a survey by Pew Research Center confirms that Republicans tend to view the economy more favorably when a Republican is in the White House, and likewise for Democrats when the situation is reversed.

Although the average annual returns on the S&P 500 during the Obama administration (+16.3%) and during the Trump administration (+16.0%) were nearly indistinguishable and exceeded the average return over the past three decades, perception of leadership drove sentiment more than actual economic results or stock market performance.

Eagle-eyed readers will also note that perception of economic conditions often changed immediately following election day or soon after, rather than after a President’s policies actually had any influence over the economy.

Is Consumer Sentiment a reliable Predictor of Market Returns?

Famed investor John Templeton once quipped: “Bull markets are born in pessimism, grow on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

As the chart below shows, over the last 60 years, the 12 months that followed a pessimistic period when consumer sentiment was low were often followed by outsized returns in the S&P 500 (+24.1% on average). By contrast, the twelve months that followed consumer sentiment peaks saw much lower returns (+3.5% on average).

The troughs in sentiment had only a modest correlation with periods of actual economic weakness, with only 4 of the troughs occurring during recessions. Likewise, sentiment was often quite high shortly before a recession was about to begin.

This inconsistency is yet another reminder that how one feels when watching the news is not a predictor of future returns. Regardless of how chaotic geopolitical events are here and abroad, staying invested and separating your feelings from your investment strategy is a prudent approach to building wealth.

Capital Markets

The S&P 500 closed at a new record high of 5,254 at the end of March before momentum reversed resulting in the major indices giving back some of the earlier Q1 gains. During April, the All-Country World Index (ACWI) declined -3.53%, the S&P 500 fell -4.51%, the EAFE fell -2.59%. and U.S. small caps forfeited all their 2024 gains in a -7.4% drop. Emerging market equities were the only area of strength, rising +0.48% for the month.