As we approach Election Day, investors are increasingly nervous about the outcome of the November Presidential election. Political anxiety is high and rising as the country seems more divided than ever.

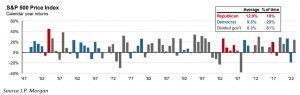

Fortunately, we have a long history of stock market returns which includes either government control by one political party or a divided government. The below chart shows S&P 500 Index returns by calendar year dating back to the 1940s:

The main takeaway is that shifts in power between Republicans and Democrats show little effect on investment results. Market returns have been healthy during Republican (+12.9%), Democrat (+9.3%) and divided governments (+8.3%). These positive outcomes are an important reminder that staying invested regardless of the outcome of elections is the wisest investment strategy. We understand that political angst is a concern, but we emphasize that the U.S. economy and stock market are driven by market fundamentals which so far this year are supportive of continued growth.

Capital Markets

In February, most major equity indices finished higher. The All-Country World Index (ACWI) was up +4.3%, the S&P 500 grew +5.3%, the EAFE gained +1.8% and Emerging market equities rose +4.8%. U.S. Small caps rebounded after a rough January, finishing up +5.7%. Bonds yields rose, pushing down returns for U.S. Bond Aggregate which fell -1.4%. Treasuries yields moved higher across the curve, with the 2-year yield reaching 4.57% and the 10-year yield at 4.19%.