Why waiting to implement your plan can reduce the benefits of your gift to your charity and you.

We all start off with the greatest of intentions: fold and put away the laundry once it’s out of the dryer, call our loved ones to see how they are doing, volunteer, start that company, and take that family vacation.

The reality is that many of us wait until the last minute, and as a result we either don’t get the full benefit of our actions or even worse wait until it is too late. The same goes for charitable giving.

Below are some ways you can act now and still have a greater impact than if you waited.

Qualified Charitable Distributions (QCDs). These allow individuals to donate up to $100,000 total to one or more charities directly from their IRA. This means you are able to start making tax-free distributions to the 501(c) (3) charity of your choice at age 70.5, which can lead to significantly more money to the causes you care about and help reduce your taxable income over your lifetime.

It’s important to get started on these distributions early and throughout the year because the distribution must be received by the charity before the end of the calendar year in order to qualify. Married couples can each donate $100,000 for a total of $200,000!

“Bunching.” This is the practice of front-loading many years of charitable giving into one tax year. Many taxpayers don’t have the necessary deductions to surpass the standard deduction threshold established by the Tax Cuts and Jobs Act in 2017.

However, you can still receive a tax benefit by “bunching” multiple years’ worth of charitable giving in one year to surpass the itemization threshold. This can be especially useful in years when you have a significant taxable event. Plus, many people like the idea of creating a legacy gifting account.

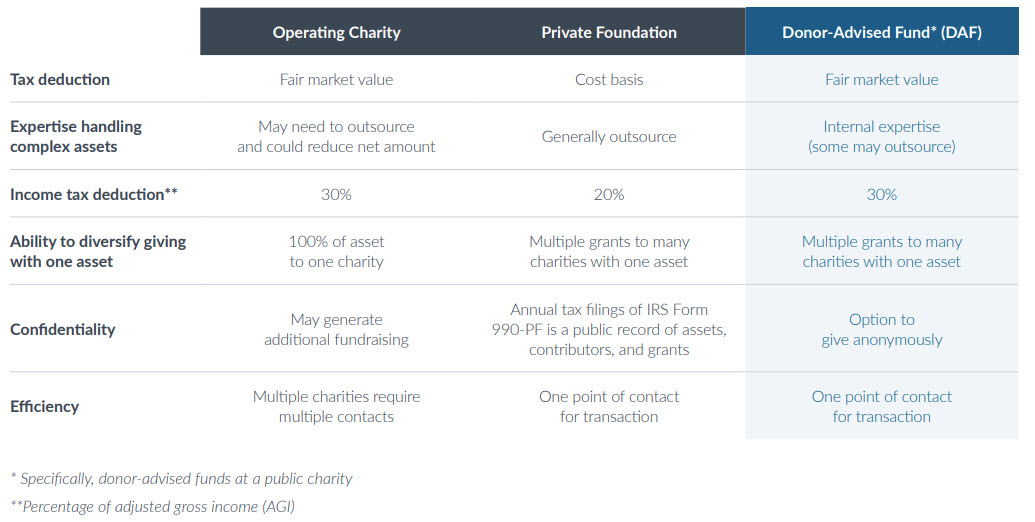

Don’t want to make such a large contribution to one charity in a year? This is where the use of a Donor Advised Fund or “DAF” can be helpful. You can make a large gift to your DAF in one year, get the maximum tax deduction, then spread out the distributions to charity over multiple years and even have the potential of the DAF to grow over time which allows for even greater gifting power.

Gifting of business ownership before you exit. Congratulations! All your years of learning and earning have led to a successful business you are looking to exit so you can enter the “serve” phase of your life. Starting your business took years of planning and preparation – and so does getting ready to exit your business in a way that achieves maximum rewards and makes the greatest impact.

Unfortunately, many business owners wait until AFTER the sale of their business to consider how to support the causes they serve and miss a tremendous opportunity to incorporate charitable giving before they exit.

Consider gifting shares of your privately held business before you exit. This allows you to get a deduction of up to 30% of your adjusted gross income at the time of the gift. More importantly, because the charity doesn’t pay taxes when the shares are sold, they get to keep the full amount of the gift!

To fully maximize this opportunity, it takes time and preparation and there are a number of tips you need to consider throughout this process:

- Ensure company documentation is in order ahead of time. Transfer restrictions may exist, so it’s important to conduct a proper review of company governing documents to determine if shareholders, partners, members, and the recipient charity are subject to those restrictions. If restrictions do exist, certain amendments may be needed which take time and approval.

- Don’t procrastinate on the qualified appraisal: For contributions of privately held securities, donors must get a qualified independent third-party valuation from a qualified appraiser to support the amount of the charitable tax deduction. In addition, appraisals can be done no earlier than 60 days before the date of donation and no later than the date of the donor’s annual tax return filing for the year the gift is given. Starting early allows the appraiser time to best understand your business share opinions on both discounts and work needed to be done for any restructuring.

- Research your charitable giving strategy carefully: There are many varieties and vehicles to choose from, and each has its pros and cons. The chart below summarizes aspects of the charitable contribution process and the impact that should be considered when donating these types of non- publicly traded assets to charity.

Source: Fidelity Charitable.

There are many ways to support the causes you care about. Whether it is through volunteering or making a financial impact, once you find what resonates with your values it is important not to hesitate to act.

If you want to learn more about what charitable strategies you might benefit from, please DON’T HESITATE to contact us at Crestwood Advisors.