CIO and Partner John Ingram advises clients to be comfortable with their asset allocations and not attempt to change them if a recession were to begin. Using a de-risking approach to protect portfolios in an economic downturn may negatively impact them, he explains in this Fortune article here.

Wealth Planner Kayla Holland discusses the importance of diversity in the finance sector with Financial Advisor

Wealth planner Kayla Holland explains how educating youth is essential to fostering a diverse sector as well as increasing awareness of what financial planners do and how they help families achieve their goals in this recent Financial Advisor article.

Read the full article here.

A Challenging Start to the New Year

2022 is off to a rough start for investors. The broad selloff across global stock and bond markets accelerated in April and has continued into May with the S&P 500 index falling over -12.5% year to date, including a dramatic -3.5% drop on Thursday.

Why?

Though the recent weakness in investment markets has lacked a single catalyst, it follows investor angst over a long list of concerns that has sharply increased uncertainty – inflation, rising interest rates, stock market valuations, slowing economic growth, deglobalization fears and war in Europe. Looking at markets in the U.S., uncertainty centers around inflation spiking to its highest level since the 1980’s.

Inflation is the Problem

The pandemic changed nearly everything. Inflation, which has been modest over the past 30 years, spiked to 8.5% last month. A pandemic-driven storm of consumer demand, supply chain constraints, and production shortages led to surging prices in goods like used cars and home goods. Making matters worse, the war in Ukraine caused food and energy prices to increase sharply. Extraordinarily tight labor markets with rising wages and soaring housing prices raise concerns that reducing inflation will now be more difficult for the Fed.

Last summer as prices started to rise, the Fed believed that inflation was ‘transitory’ and was slow to react. This policy error has undermined investor confidence and added to uncertainty. Investors are now realizing that regaining control over inflation will take time and be more difficult than previously thought.

Shifting Monetary Policy

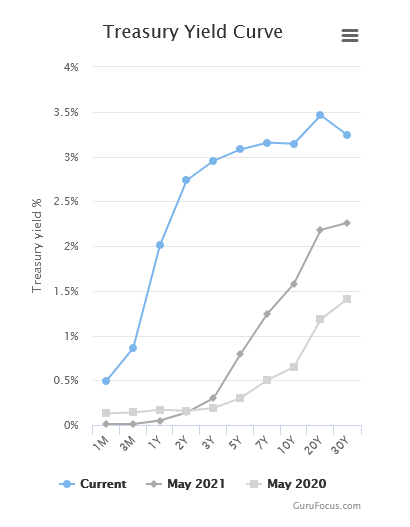

To bring inflation back under control, the Fed has started to increase short-term interest rates with plans to continue to do so in steps over the next several months. In anticipation of future Fed rate increases, market interest rates have risen sharply this year. (See chart below.)

Though the increase in market yields has been swift and severe, it is too early to say rates have peaked. How aggressive the Fed’s pace of future rate hikes will depend on the direction of inflation and economic activity. The Fed is walking a narrow path to raise rates sufficient to slow inflation but not raise rates too far too fast to damage the economy and create a recessionary slowdown. Importantly, with the Feds’ objective to slow the economy, we should anticipate that economic results will be more challenging and may add to uncertainty and volatility.

Stock Markets and Recession Concerns

The Fed is also further shifting their monetary policies from so called “Quantitative Easing” (QE) to a more restrictive monetary policy, “Quantitative Tightening’ (QT). Such changes will naturally impact businesses and the prices of stocks.

Higher interest rates also raise the “discount rate” used to value future business earnings, which mathematically lessens stock valuations. While the higher discount rate will impact all stock valuations, growth companies whose valuation rely heavily on earnings well into the unknown future are affected even more so. This is most apparent in many technology companies and investment funds targeting future innovation and one reason why the NASDAQ declines are greater than 20% and why certain investment products holding so-called “innovation” and “next gen” businesses have fallen 50%-70%. These businesses rely heavily on outside capital to fund their ambitious growth goals and will have a particularly difficult time in a QT world where access to money is scarce.

Is There any Good News?

The good news is that the U.S. economy is still exceptionally strong. U.S. households are arguably in the best condition in modern history with high savings, income growth and low debt service levels. Additionally, labor markets remain strong with over 11.5 million job openings, compared to less than 8 million before the pandemic, and wage growth is healthy, especially for hourly wage earners, which ultimately further strengthens households and consumers.

Stock market valuations have also improved with the recent declines and the fundamentals of the businesses that dominate our portfolios remain mostly strong and earnings continue to grow. Despite some high-profile earning misses, many companies continue to meet or exceed earnings expectations. In these differentiated markets, we believe owning businesses that can weather this storm with pricing power and strong earnings growth is critical. Though market volatility is painful, we believe our positions in quality stocks and funds will be better able to withstand the macro risks and generate competitive returns.

Opportunities in Portfolios

The broad stock market weakness has resulted in significant declines across most stocks, including many high-quality businesses that were formerly too rich in valuation for us to find worthwhile to include in client portfolios. For some of these businesses, the recent declines have seemed to overly-discount a future that we believe to be still bright and we have been able to add these high-growth businesses to further strengthen portfolios.

Bond markets have also been rattled and off to one of the worst starts of any previous calendar year. The very low interest rate environment of recent years caused us to favor shorter-duration and high-quality bonds as there was simply insufficient income being generated to be compensated for taking on significant credit or interest-rate risk. The recent spike in short-term rates (see chart above) has provided us another opportunity, where appropriate, to further shorten bond duration, improve quality and enhance the yield profile.

Similar to the early spring of 2020, the market weakness and volatility is allowing us the opportunity to harvest available tax losses, among both equity and bond holdings, so that we mitigate already realized gains or create an asset to help shelter future gains.

Since the onset of the pandemic, we have faced higher uncertainty and a series of unprecedented macro events from economic shutdowns to fiscal/monetary stimulus and now inflation and a reversal of monetary policy. While at times the stock market may feel like a rollercoaster, these periods are often ultimately beneficial for investors who remained invested. Since the bottom of the market during the onset of the pandemic, the S&P 500 index is still up over 90%. During these volatile periods it is important to avoid making emotionally charged decisions and strive to remain focused on long-term goals and stick to one’s investment plan.

Crestwood Partner, John Ingram, Discusses Long-Term ETF Success with ETF.com

The current energy shock has investors playing around with their portfolios to drive long-term success. Recently, CIO John Ingram spoke with ETF.com about the importance of digging into ETFs to find the proper exposure to match a set theme. Read the full story here.

Crestwood Partner Discusses Commodities with Forbes

Some see commodities as essential long-term investments to support retirement plans. Commodities outperform when inflation strikes. Recently, CIO and partner John Ingram spoke with Forbes about the advantages and disadvantages of commodities. Interested in learning more?

Ukrainian War – A Humanitarian Disaster

A Humanitarian Disaster

Even as the war unfolds “live” in real time, it is hard to comprehend the scale of the humanitarian costs for those in Ukraine. Estimates already suggest that over 2 million refugees have fled the country. As the war drags on, Ukraine will face a rising death toll, shortages of essential goods and worsening of the crisis. The methods of the Russian President, Vladimir Putin, are ruthless and include the use of banned weapons on civilians. It appears that Putin will continue to escalate forces and tactics to bring Ukraine to its knees and, sadly, a truce seems distant. Surging Ukrainian national pride and a willingness to fight for their freedom, argues for a prolonged and destructive battle. Putin’s willingness to use force to obtain his larger goal of rebuilding the former USSR is a threat the world now takes seriously.

Though we are in the early days of this conflict, Putin’s aggression has many geopolitical implications. Since the invasion began, market volatility has jumped as investors have flocked to safe assets like U.S. Treasuries. More recently, the volatility has further increased as world leaders have acted with a high degree of unison in applying layer upon layer of sanctions. Notable was the first ever sanction of a central bank which froze most of Russia’s foreign reserve assets. On Monday, March 7th, selling pressure accelerated as many countries openly discussed banning Russian energy imports, sending gas and oil prices soaring.

Although the current volatility raises the appeal for investing in commodities, long-term returns for commodities have been pitiful. Since 2000, the S&P 500 is up 354% while a broad basket of commodities is up only 24%. Commodities generate returns through price change only, while stocks compound earnings and dividends. Over time this growth in earnings and dividends is a powerful driver of returns and builder of wealth in client portfolios.

Energy prices are at the nexus between war and sanctions. While countries are trying to maximize the effect of sanctions, Europe is reliant on Russia for 40% of their energy. Germany has few options to source their gas other than from Russian pipelines. Prices for natural gas in Europe have soared and are trading at approximately 15x natural gas prices in U.S.

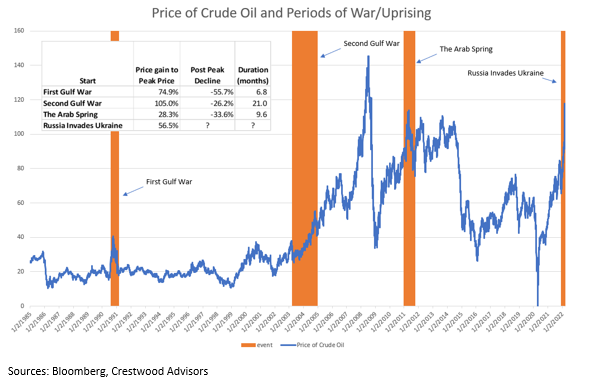

Historically, energy prices are cyclical, moving in tandem with economic growth and prices tend to fall sharply during recessions when demand slows. Wars in regions that produce energy typically cause energy prices to spike. These increases have historically proven to be temporary, except for the second Gulf War beginning in 2003, which was in the middle of a prolonged energy shortage. Prices tend to decline once supply chains and production levels adjust. Hence, these large price swings in commodities makes investment timing very difficult.

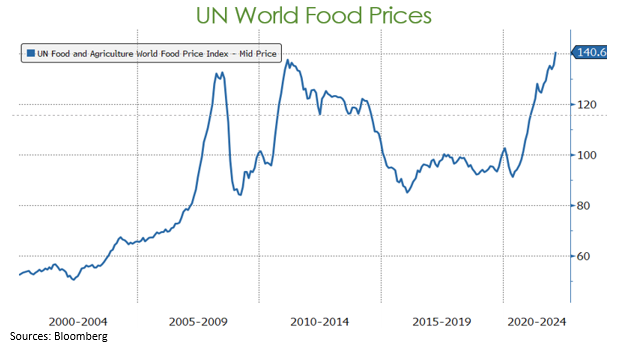

In addition to being significant world suppliers of oil and gas, Russia and Ukraine are also significant producers/exporters of important grains. As the chart below highlights, food prices have also risen to record highs.

U.S. Economy

From a U.S. economic perspective, the current invasion is likely to remain less impactful to domestic economic growth. While we do not want to minimize the human tragedy, over time, investment markets tend to follow “economic” events and, for better or worse, discount wars and other geopolitical events (see chart below). According to a Bloomberg survey of economists, global GDP estimates for 2022 have fallen from 4.5% to 4.3%, so economists are still expecting solid GDP growth.

Our base scenario remains that U.S. economic growth will remain healthy and equity investors will be rewarded for not panicking. That said, this conflict is a major and evolving humanitarian crisis, which will affect energy and commodity markets, particularly in Europe. We remain committed to well diversified portfolios that should serve as a buffer as we navigate through these challenging times. We will continue to make modest adjustments in client holdings where fundamentals remain healthy, and valuations are compelling. Please reach out to your Crestwood team if you have any specific market or portfolio questions or concerns.

Crestwood Partner Talks Tax Landscape with Financial Advisor

Tax season is upon us and while new federal tax changes have stalled, high-net-worth individuals could still see significant changes ahead. Recently, Alyson Nickse, wealth manager and partner, spoke with Financial Advisor about the tax shifts we may see this year and strategies high earners can implement to reduce their tax liabilities.

Click here to read more.

A Tumultuous Stock Market to Start the New Year

What’s Happening In Equity Markets?

The new year has started with a tumultuous U.S. stock market and the broader economic and investment environment is one of heightened risks. COVID remains a central theme and is contributing to inflationary pressures (i.e. strained supply chains, production slowdowns) and impairing the workforce and productivity, causing slowing GDP growth expectations. Concerns over accelerating inflation has caught the attention of the Fed and markets are now pricing in 3-4 rate increases and a shift from Quantitative Easing (QE) to Quantitative Tightening (QT). The shift to QT will be a difficult balancing act as “too slow” may not sufficiently dampen inflation and “too fast” risks a recession. Neither of these outcomes are great for investors so we’re likely to see some stock market swings as investors judge the relative success of the Fed.

The concerns of tighter monetary policy and a slowing economy have already been hitting the “growthiest” stocks and other speculative investments. “Meme” stocks are buckling, pandemic darlings like Peloton & Zoom have cratered and even the “future of money” cryptocurrencies are down significantly. Cathie Wood, founder of ARK Innovation funds, got a lot of attention in 2020 as her “disruptive innovation” ETF strategies exploded higher have now lost ~50% over the past year. Even with such carnage, too many money-losing tech companies remain generously valued based on robust growth expectations that may or may not be forthcoming. A world with QT and higher interest rates makes the potential for profitability more difficult and tossing in a recession ensures some of these types of businesses will be lucky to survive.

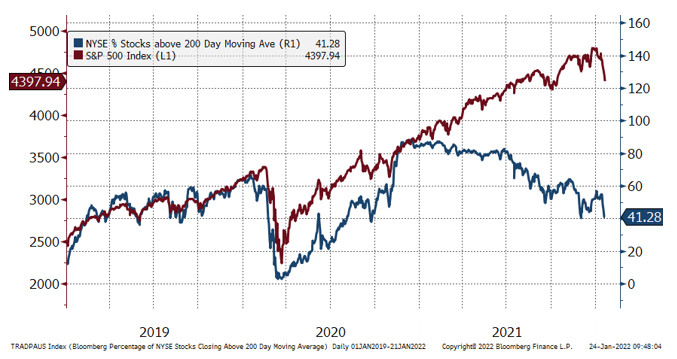

While stock prices for many individual companies are down significantly with many stocks trading well below their 200 Day moving average (see chart below), broader market indices are down more modestly. So far in 2022, the tech-heavy NASDAQ composite is down about 13%, the S&P 500 is down 8% and the Dow Jones Industrial Average is down a bit more than 6%.

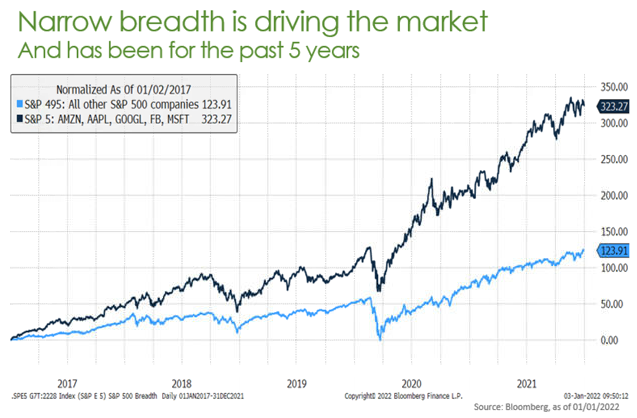

A closer look at the S&P 500 shows some of the risks as well as some explanation as to why this index continues to hold its ground. As highlighted in the chart below, 5 stocks (Microsoft, Amazon, Alphabet, Meta, Apple) have dominated the S&P 500 index in recent years and the performance gap between the “S&P 5” and “S&P 495” has exploded ever wider over the last 24 months. We have been fortunate to widely own AAPL, GOOGL & MSFT during this time given what we believe are their strong operational characteristics and favorable valuation levels. Today, if you add Tesla to this group, the top 6 stocks represent about 25% of the total S&P 500. This is highly unusual and the last time stock markets were so concentrated in just a few names was in tech boom of late 1990s, which didn’t end so well when investors eventually began to question the growth assumptions built into the rich valuations of those stocks.

Importantly, this does not suggest we are on the precipice of a similar market “crash” as we experienced when the tech/telecom bubble burst in the early 2000s, but we do not believe this performance gap is sustainable. The concentration of the S&P 500 in just a handful of companies presents a heightened level of risk for the market, especially should anything (i.e. slowing growth, more aggressive regulation, etc.) specifically adverse happen to any of those 5-6 businesses.

In general, with the possible exception of Tesla, valuations of these top stocks are much lower than what occurred during the tech bubble of the late 1990s. The charts below highlight how AAPL, MSFT, GOOG & FB generate enormous cash flow and are significantly more profitable companies vs. the S&P 500.

Where we see opportunity?

We believe near-term weakness and enhanced volatility creates longer-term opportunity. While GDP growth may slow, the economy is still expanding and consensus earnings growth for the S&P 500 is expected to be up nearly 10% for 2022. Higher interest rates may adjust market multiples lower but, as always, we believe businesses with leading positions in secular growing industries that are self-financing with strong positive cash flow will have advantages in both a slowing economy and during any QT when access to outside capital becomes more difficult. Our portfolios are filled with such businesses and we remain committed to investing in a diversified portfolio of such strong businesses in order to mitigate risk and protect against an always unknown future.

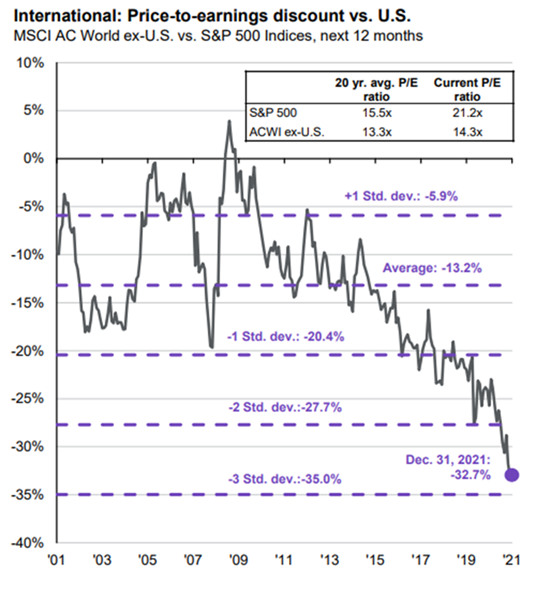

It is also worth noting, that the U.S. stock market’s “advantages” vs. the rest of the world may be fading and valuations of international stocks relative to the U.S. have grown extraordinarily wide (See chart below). Last year, the U.S. got an economic & profit boost from more front-loaded monetary (i.e. asset purchases) and fiscal (i.e. the direct stimulus payments) policies but these are now largely done or slowing. In contrast, the Eurozone had more backend- loaded measures including loan guarantees to businesses/individuals and broader reserve lending, which may lead to faster earnings growth vs. the U.S. in 2022. Given current valuation levels, this would boost relative returns from international & emerging market stocks.

What you should expect

We remain disciplined in our approach to constructing risk-appropriate portfolios that enhance the opportunity for each client to achieve their individual goals. Generally speaking, this includes a healthy allocation to sometimes volatile equities. Stock market volatility is always uncomfortable but periodic declines in stock prices are an unfortunate part of the experience in seeking the higher long-term returns offered by investing in the stock market. March 2020 was the last significant downturn in stocks and we don’t know whether the current weakness will prove to be as short-lived but we do see a constructive economic environment supported by a recovering labor market and solid corporate earnings growth. We intend to use any near-term weakness and volatility to improve portfolios, perhaps adding to current investments that may trade lower but where we see our long-term thesis for the business intact. Likewise, our research team continues to evaluate opportunities that any further market weakness may make more attractive.

Extreme valuations and get-rich-quick schemes like retail investors chasing “meme” stocks distort performance and will eventually harm those who got in too late. While the unwinding of the more speculative investments may take time and involve some pain, a renewed focus on the importance of business fundamentals together with a rational long-term investing will increase market stability and reward those with a disciplined consistent approach.

Should you like to discuss the current environment or other matters related to your investment portfolios, we encourage you to reach out to your Wealth Team.

We remain humble and grateful for the opportunity to be working with you.

Crestwood Advisors Names New Partner, Promotes Staff

FOR IMMEDIATE RELEASE

New England RIA firm committed to growth from within

Boston, Mass. (January 6, 2022) – Crestwood Advisors (“Crestwood”), a boutique investment advisory and wealth management firm based in Boston, is excited to announce newly-appointed firm Partner Leigh Hurd, CFA, as well as the promotions of three other teammates:

- Kayla Holland, CFP®, has been named Director, Wealth Planner

- Peter Malone, CFA, CFP®, has been named Director, Portfolio Manager

- Brandon Lozier has been named Client Advisor

“Our greatest asset is our people. We’re proud to foster an environment that champions growth from within and we are committed to recognizing and rewarding our team’s talent and integrity with opportunities for advancement and self-improvement,” said Crestwood CEO/Managing Partner Michael Eckton.

Hurd joined Crestwood as a Portfolio Manager and Director in 2013. She has spent close to 20 years building relationships with individuals and families to help structure their investment portfolios to meet their life goals. She holds the Chartered Financial Analyst designation and is a member of the CFA Society Boston and the CFA Institute. She earned her bachelor’s and master’s degrees from Boston College’s School of Management.

“Crestwood is extremely pleased to share the news of Leigh’s partnership, as well as the promotions of Kayla, Peter and Brandon. Together and individually, each of our team members are willing to adapt, learn and evolve – all in the name of putting clients first through our recommendations and actions,” said John Morris, Managing Partner and Wealth Manager.

Over the past three years, the firm has doubled to a total of 42 fiduciary professionals who strive to meet clients wherever they are in life and provide guidance, tools and solutions to help them succeed. Strategic hires and opportunities for internal advancement have poised Crestwood for continued growth in years to come.

Crestwood Advisors’ Team Advancing Industry Roles, Skillsets

FOR IMMEDIATE RELEASE

Client advisors named director of regional committee, earn CFP® designation

Boston, Mass. (December 20, 2021) – Crestwood Advisors (“Crestwood”), a boutique investment advisory and wealth management firm based in Boston, is proud to announce the recent accomplishments of Client Advisors Kayla Holland and Tiffany So.

Holland was elected Director of the NexGen Committee within the Financial Planning Association (FPA) of New England, while So recently earned the Certified Financial Planner (CFP) designation.

The New England chapter in Massachusetts, which has the second largest NexGen chapter in the country, is dedicated to serving aspiring and early-career financial planners. An organization that prides itself on thought leadership, its members are proud to bring energy, enthusiasm and new perspectives to the forefront of the financial planning industry in an effort to ensure standards are forward-thinking and addressing ever-evolving client needs.

An esteemed credential, the CFP designation has been the standard of excellence for financial planners for 30 years. CFP professionals complete extensive training and commit to the CFP Board’s ethical standards, which require designees to put their clients’ interests first, among other things.

“We’re extremely proud to have Kayla and Tiffany on our team,” said Crestwood CEO/Managing Partner Michael Eckton. “Their contributions to the success of our clients, the firm and our communities are admirable and inspiring. We remain grateful for their talent and their efforts and look forward to the impact they’ll make at Crestwood and in our industry for years to come.”