2022 is off to a rough start for investors. The broad selloff across global stock and bond markets accelerated in April and has continued into May with the S&P 500 index falling over -12.5% year to date, including a dramatic -3.5% drop on Thursday.

Why?

Though the recent weakness in investment markets has lacked a single catalyst, it follows investor angst over a long list of concerns that has sharply increased uncertainty – inflation, rising interest rates, stock market valuations, slowing economic growth, deglobalization fears and war in Europe. Looking at markets in the U.S., uncertainty centers around inflation spiking to its highest level since the 1980’s.

Inflation is the Problem

The pandemic changed nearly everything. Inflation, which has been modest over the past 30 years, spiked to 8.5% last month. A pandemic-driven storm of consumer demand, supply chain constraints, and production shortages led to surging prices in goods like used cars and home goods. Making matters worse, the war in Ukraine caused food and energy prices to increase sharply. Extraordinarily tight labor markets with rising wages and soaring housing prices raise concerns that reducing inflation will now be more difficult for the Fed.

Last summer as prices started to rise, the Fed believed that inflation was ‘transitory’ and was slow to react. This policy error has undermined investor confidence and added to uncertainty. Investors are now realizing that regaining control over inflation will take time and be more difficult than previously thought.

Shifting Monetary Policy

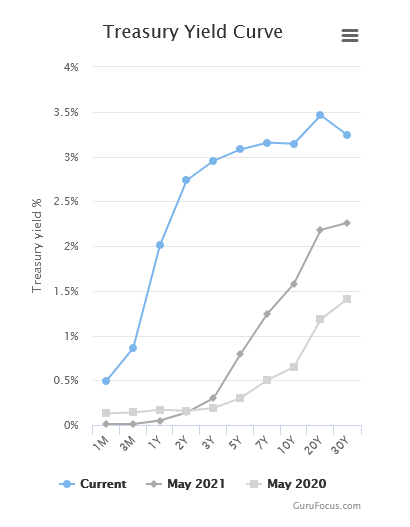

To bring inflation back under control, the Fed has started to increase short-term interest rates with plans to continue to do so in steps over the next several months. In anticipation of future Fed rate increases, market interest rates have risen sharply this year. (See chart below.)

Though the increase in market yields has been swift and severe, it is too early to say rates have peaked. How aggressive the Fed’s pace of future rate hikes will depend on the direction of inflation and economic activity. The Fed is walking a narrow path to raise rates sufficient to slow inflation but not raise rates too far too fast to damage the economy and create a recessionary slowdown. Importantly, with the Feds’ objective to slow the economy, we should anticipate that economic results will be more challenging and may add to uncertainty and volatility.

Stock Markets and Recession Concerns

The Fed is also further shifting their monetary policies from so called “Quantitative Easing” (QE) to a more restrictive monetary policy, “Quantitative Tightening’ (QT). Such changes will naturally impact businesses and the prices of stocks.

Higher interest rates also raise the “discount rate” used to value future business earnings, which mathematically lessens stock valuations. While the higher discount rate will impact all stock valuations, growth companies whose valuation rely heavily on earnings well into the unknown future are affected even more so. This is most apparent in many technology companies and investment funds targeting future innovation and one reason why the NASDAQ declines are greater than 20% and why certain investment products holding so-called “innovation” and “next gen” businesses have fallen 50%-70%. These businesses rely heavily on outside capital to fund their ambitious growth goals and will have a particularly difficult time in a QT world where access to money is scarce.

Is There any Good News?

The good news is that the U.S. economy is still exceptionally strong. U.S. households are arguably in the best condition in modern history with high savings, income growth and low debt service levels. Additionally, labor markets remain strong with over 11.5 million job openings, compared to less than 8 million before the pandemic, and wage growth is healthy, especially for hourly wage earners, which ultimately further strengthens households and consumers.

Stock market valuations have also improved with the recent declines and the fundamentals of the businesses that dominate our portfolios remain mostly strong and earnings continue to grow. Despite some high-profile earning misses, many companies continue to meet or exceed earnings expectations. In these differentiated markets, we believe owning businesses that can weather this storm with pricing power and strong earnings growth is critical. Though market volatility is painful, we believe our positions in quality stocks and funds will be better able to withstand the macro risks and generate competitive returns.

Opportunities in Portfolios

The broad stock market weakness has resulted in significant declines across most stocks, including many high-quality businesses that were formerly too rich in valuation for us to find worthwhile to include in client portfolios. For some of these businesses, the recent declines have seemed to overly-discount a future that we believe to be still bright and we have been able to add these high-growth businesses to further strengthen portfolios.

Bond markets have also been rattled and off to one of the worst starts of any previous calendar year. The very low interest rate environment of recent years caused us to favor shorter-duration and high-quality bonds as there was simply insufficient income being generated to be compensated for taking on significant credit or interest-rate risk. The recent spike in short-term rates (see chart above) has provided us another opportunity, where appropriate, to further shorten bond duration, improve quality and enhance the yield profile.

Similar to the early spring of 2020, the market weakness and volatility is allowing us the opportunity to harvest available tax losses, among both equity and bond holdings, so that we mitigate already realized gains or create an asset to help shelter future gains.

Since the onset of the pandemic, we have faced higher uncertainty and a series of unprecedented macro events from economic shutdowns to fiscal/monetary stimulus and now inflation and a reversal of monetary policy. While at times the stock market may feel like a rollercoaster, these periods are often ultimately beneficial for investors who remained invested. Since the bottom of the market during the onset of the pandemic, the S&P 500 index is still up over 90%. During these volatile periods it is important to avoid making emotionally charged decisions and strive to remain focused on long-term goals and stick to one’s investment plan.