One Small Cut, More to Come

In last month’s Economic Update, we identified four areas of particular interest regarding the upcoming September meeting of the Federal Reserve’s Open Market Committee (FOMC).

The Interest Rate Decision

We expected the Committee would lower the federal funds rate by 0.25% to 4.00% -4.25% based on a generally held view that the economy was slowing. In a nearly unanimous 11-1 decision, members voted to drop rates by a quarter percent. The lone dissenter was the newly appointed Fed Governor, Stephan Miran, who was in favor of a more aggressive 0.50% reduction.

Forward Guidance

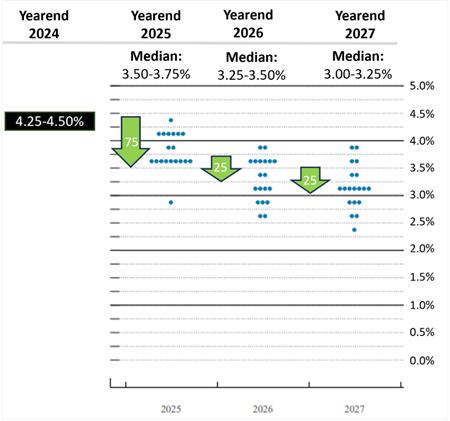

The FOMC updated its Statement of Economic Projections (SEP), commonly referred to as the “Dot Plot,” at the September meeting.

As noted last month, the SEP outlines where individual Fed members expect inflation and interest rates to trend over the coming quarters and provides members’ future year-end target ranges. Investors watch the Dot Plot closely for insight into the Fed’s future policy path and interest rate expectations which, in turn, influence everything from bond yields to equity valuations.

The chart below shows the updated SEP dot plot for September. Each blue dot on the chart represents the opinion of one of the 19 FOMC participants.

September 2025 Fed Dot Plot Showing Projected Target Range of Fed Funds Rate and moves per calendar year (Green Arrows)

Source: September 17, 2025 FOMC Summary of Economic Projections and Bondsavvy calculations.

The median of the September dot plot projections sees the Fed Funds rate falling by a further 0.5% in 2025, an additional 0.25% in 2026 and 2027.

The dot plots as a group have shifted down 0.25% for each calendar year, apart from the outlier (Miran) who projected a significantly lower rate in 2025 and 2027 than the rest of the FOMC.

Dissent!

Stephen Miran, who formerly served as Chairman of Economic Advisers in the current Trump Administration, argued the Federal Funds rate is currently about 2% too high, proposing that structural shifts in immigration, tariffs, regulation, and tax policy have pushed the “neutral” rate downward. The neutral rate is the theoretical “sweet spot” where the economy has both full employment and stable inflation.

Miran asserted that the inflationary pressure from policy changes is overstated, especially pressure attributed to tariffs, and that more aggressive easing is necessary to forestall deterioration in labor markets.

While Miran’s views are consistent with those of the Administration, they stand in contrast to the majority view on the FOMC that changes to American policy (tariffs, immigration) continue to be a near-term reinflationary risk.

Inflation and Labor Market Trends

Powell emphasized that while inflation has eased from its peaks, it “remains somewhat elevated,” especially noting that goods prices have driven part of the pickup in inflation recently. PCE rose 2.0% over the 12 months ending in August. While overall unemployment remains low, Powell described it as a “low-firing, low-hiring environment” noting that younger people entering the workforce are having a hard time finding work.

Overall, economic data is somewhat mixed. Labor markets are slowing, but not collapsing, which is consistent with the Fed lowering interest rates. However, the economy seems to be humming along. Q2 GDP came in at 3.8% quarter over quarter, boosted by healthy consumption. The US consumer continues to spend. Forecasts for Q3 show this trend continuing. According to the Atlanta Fed, the GDPNow forecast for Q3 is projected to come in at 3.8%, which suggests the economy is still on reasonable footing, even if the economic terrain appears uneven.

Closing Time – The Federal Government Shuts Down (Again)

Effective October 1st, the Federal Government has shut down.

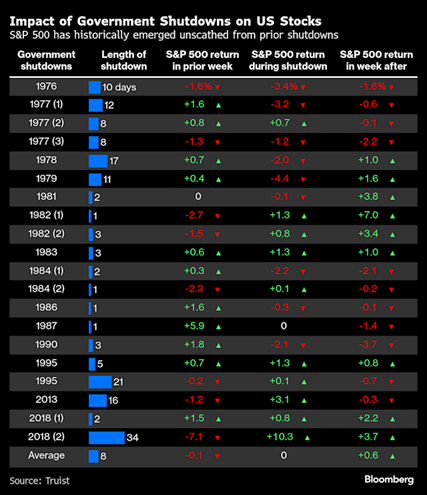

Over the last 50 years, the US government has shut down a remarkable 21 times. Most shutdowns have been brief, lasting only a few days.

The current shutdown is interesting for several reasons:

- In the past, these typically occurred at times when Congress had already passed some funding resolutions, so the shutdown only impacted a subset of government agencies. In the current case, Congress has not passed any annual spending bills, so this would result in funding for all agencies to lapse.

- Office of Management and Budget Director Russell Vought has indicated that in addition to the usual furloughs, the administration may start to permanently fire federal employees in the days to come.

- The longest shutdown of the last 50 years was the most recent one: December 2018’s 35-day shutdown during the previous Trump administration.

What are the Effects of a Shutdown?

The immediate effect is furlough – temporary unemployment – of ~40% of federal employees considered non-essential. Furloughed employees are reimbursed for lost pay when they return to work. These employees hold a variety of roles across the economy, so their absence manifests in a host of ways: travelers would expect longer travel times at the airport (fewer TSA employees), potential changes at the grocery store (fewer USDA food inspectors), closures of national parks (fewer park workers) and so forth. If the shutdown is brief, the economic disruption is primarily felt by the furloughed Federal workers.

Historically, financial markets have typically shrugged off government shutdowns. Goldman Sachs notes that 10 yr Treasury yields and the USD, which are a barometer of the global financial system’s faith in the smooth functioning of the US government, have typically weakened following government shutdowns and subsequently taken time to recover once the government reopens. However, these effects are not long-lasting.

US equity markets have likewise seen muted impacts from shutdowns, as shown in the chart below:

When might we see a resolution?

There is no reliable way to predict the duration of the shutdown. Military pay, which stands to be impacted this time around, has historically encouraged a deadline for reopening. The first military pay date at risk is October 15th. Another deadline for a possible resolution could be the second week of October, when funding for the Women Infants and Children (WIC) nutrition program is set to run out of money.

Given the uncertain, and likely temporary market impact associated with the shutdown, we recommend clients maintain their long-term investment focus and avoid a change in strategy as a result of the current shutdown.

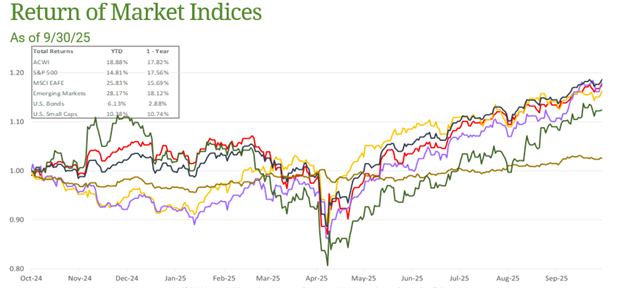

Capital Markets

As the Fed moved to cut rates, all boats rose with the tide in September. Equity markets saw the biggest moves, with the All Country World Index (ACWI) rising 3.7%. The S&P 500 was slightly behind, climbing 3.6% for the month. Emerging market equities surged 7.2% while International Developed stocks, as measured by the EAFE, increased by 2%. US Small Cap equities, measured by the Russell 2000, had another strong month, increasing by 3.1%. US bond prices rose 1.1% for the month.

Source: Bloomberg. EAFE is MSCI EAFE Index(1), Emerging Markets is MSCI Emerging Markets(2) and U.S. Bonds is Barclays U.S. Aggregate(3). ACWI is the MSCI ACWI Index(4). Small Caps is the Russell 2000 Index(5). S&P 500 is the S&P 500 Index(6). The above information is as of 9/30/2025.