Uncertainty around economic policy has become a defining feature of recent economic and financial market news. This heightened period of ambiguity has been extreme and is affecting financial markets and expectations for the future of the economy.

Investors and businesses are operating with limited information during the current “pause” in tariff activity. However, we anticipate the current lack of clarity to subside as specific details surrounding trade policy emerge leading up to the July 9th deadline. The U.S. economy has demonstrated resilience through this rocky period, with higher-than-expected job growth and a continued abundance of job openings.

Measuring the Unknown

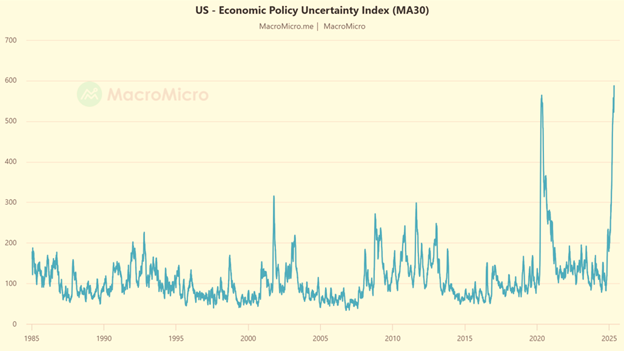

Economists are a clever bunch and have developed tools to measure uncertainty, including scanning top news articles and counting usage of similar terms. It is no surprise that this sentiment affects decisions around consumption, investment, hiring and even monetary policy.

As measured by the U.S. Economic Policy Uncertainty Index1, the numbers spiked around tight presidential elections, the Gulf Wars, the 9/11 attacks, during the COVID-19 crisis and more recently, the 2025 Trump Tariffs. The gray boxes on the chart below indicate recession periods, illustrating a correlation between economic uncertainty and financial distress.

Uncertainty is Temporary

We expect continued volatility in the markets until economic policy mandates and goals become clearer, and consequences become more predictable

However, as long-term investors, we understand that while “fiscal fog” may persist for a time, it is not permanent. History has shown that markets often respond favorably once a measure of predictability returns.

Case in point: the size and scope of the Liberation Day tariffs caught investors off guard, causing stock prices to fall. In an unusual move, bond prices also declined. However, the subsequent announcement of the 90-day “pause” to allow time for international negotiations quickly restored order to the markets. In the weeks that followed, many stocks recovered to pre-Liberation Day levels. In fact, the S&P 500 finished April down only 0.7%.

As we navigate these turbulent market waters, it’s helpful to remember a time-tested investing maxim: “Where there is Volatility, there is often Opportunity.” Attractive investment opportunities can emerge during periods like these, when some investors trade quickly based on emotion rather than staying focused on data and analysis.

Patience and discipline tend to pay off in the long run.

Capital Markets

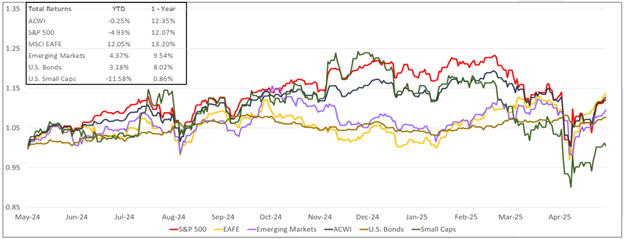

Equities were mixed in April. The S&P 500 fell sharply following the Liberation Day announcement, but recovered after the “pause” to finish down 0.7%. The All-Country World Index (ACWI) rose slightly, finishing up 0.77%. Developed international equities, as measured by the EAFE index, had a strong month, rising 4.17%. Emerging market equities increased by 1%. Bonds were nearly flat, posting a 0.39% gain.

Source: Bloomberg. ACWI is the MSCI All Country World Index, EAFE is MSCI EAFE Index, Emerging Markets is MSCI Emerging Markets and U.S. Bonds is Barclays U.S. Aggregate. Small Caps is the Russell 2000. The above information is as of 4/30/2025.

At Crestwood Advisors, we’re passionate about guiding our clients toward their long-term goals, easing their concerns, and helping them make the most of the opportunities that wealth brings. If you are not yet working with Crestwood, we would love to start a conversation!

1The U.S. Economic Uncertainty Index was first introduced by Scott Baker, Nicholas Bloom, and Steven Davis in an NBER Working Paper Series, Measuring Economic Policy Uncertainty, Working Paper 21633, published by the National Bureau of Economic Research. http://www.nber.org/papers/w21633