2025 was a year of economic uncertainty and concern, but also of resilience and growth. In this month’s Economic Update, we look back at the issues that dominated our thinking on the economy and financial markets each quarter and then look forward to what we’re focused on in 2026.

Q1: Fear of the Unknown

As the Trump administration in Washington found its footing, expectations for global trade reform loomed large. In Q1, our attention was on the impact that tariffs could have on inflation and economic growth, and how the unpredictability of outcomes could spook the financial markets.

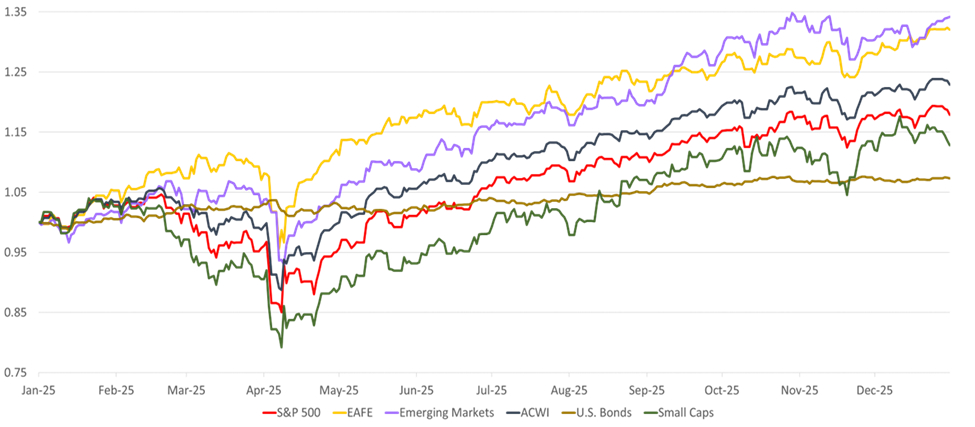

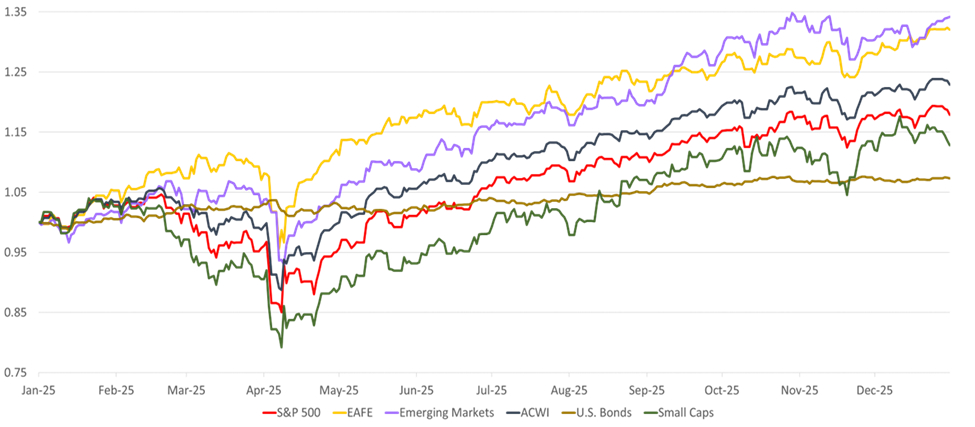

A reactionary massive surge in imports contributed to a contraction in GDP of 0.5% in quarter1. At the same time, inflation remained elevated, leading the Fed to keep its restrictive monetary policy in place. In this uncertain environment, the US stock market struggled for direction as investors feared that recession, or even stagflation, might be on the horizon. By quarter’s end, volatility had returned to the market, and the S&P 500 had lost 4.3%.

In our March update, we reminded investors of the resilience of American institutions and advised them to remain patient, focusing on long-term goals rather than short-term volatility. This advice would serve them especially well in the quarter to come.

Q2: Liberation Day Selloff and Recovery

The second quarter began with the Liberation Day announcement of sweeping tariffs on America’s trading partners. The size and scope of the tariffs caught investors off guard, resulting in a swift selloff across equity markets, including an 11% decline in the S&P 500.

We pointed out that periods of extreme uncertainty may persist for a time, but they are not permanent, and that markets react favorably once a measure of predictability returns.

The announcement of a three-month “pause” in the tariff rollout signaled such a window of predictability. By the end of the quarter, equity markets had recovered, and the S&P was up nearly 6% YTD.

Q3: Shooting the Messenger and Divergence at the Fed

Tariff risk persisted into the third quarter; however, delayed implementation timelines and constructive progress in trade negotiations helped ease market concerns. In Q3, the Bureau of Labor Statistics revised estimates on job growth downward. The reaction was swift: President Trump fired the head of the BLS, the dollar weakened, and equity markets declined. Though the Fed was divided on the pace of rate cuts, the slowing economic data proved enough to convince them to cut rates by 0.25% in September. Equity markets responded favorably, with the S&P 500 rising by a healthy 7.8% in the quarter.

Q4: Closing Time and K-Shaped Data

The fourth quarter began with the shutdown of the Federal government. While every shutdown is unique, we expected the impact on equities to be modest and temporary, and recommended clients stay the course rather than trading on this news. This was indeed sound advice. Despite becoming the longest shutdown on record, the impact on equity markets was mild.

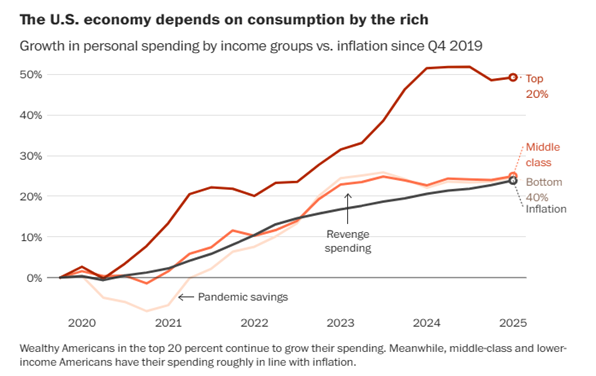

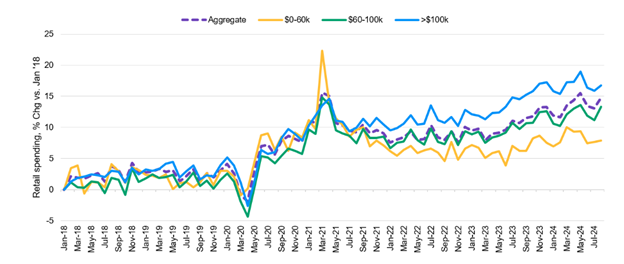

As economic growth took center stage toward year-end, we brought attention to the distinctive nature of the current K-shaped data, which evidenced a bifurcated mix of “winners and losers” in equity markets, higher vs. lower-income households, and other areas of the economy.

The fourth quarter was a victor lap for patient equity investors. The government reopened, and the Fed committed to a “normalization” path with 0.25% rate cuts in October and December.

Looking Ahead: 2026 Rhymes, but will not Repeat

We believe three trends will play out in 2026:

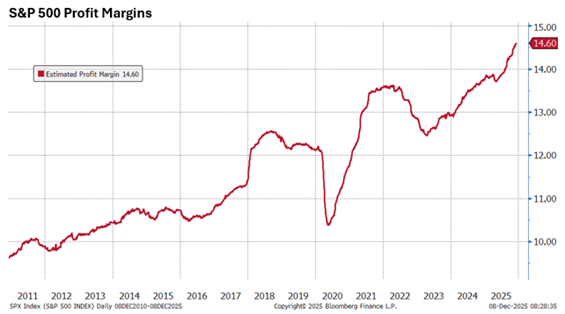

- Steady Fundamentals. The US economy remains resilient, benefitting from pro-growth fiscal policy, healthy corporate balance sheets, and robust consumer spending, with the anticipated 2026 tax rebate likely to provide a modest incremental boost to household consumption and aggregate demand.

- (Relative) Rate Stability. We expect monetary policy to normalize with a bias towards slowly lowering rates. Incoming Fed members are likely to be sympathetic to the administration’s preference for lower rates. Compared to the last 6 years, where rates rose from zero to over 5% rapidly and then gradually trickled down, we are entering a period of relative stability. In addition, there is a potential for lower rates regardless of economic trends. Stability and lower rates benefit both companies and investors.

- Earnings Expansion 2. Meaningful earnings growth likely won’t be confined to AI stocks and the Magnificent 7 3 in 2026. There is a pronounced shift in earnings expectations toward companies beyond the Magnificent 7. While Mag 7 stocks are still expected to deliver strong earnings growth, the change in year-over-year expectations is modest – only +2% higher in 2026 (+22.7% vs. +22.3% for 2025). By contrast, analyst earnings estimates for the other 493 companies are 33% higher for 2026 than in 2025 (+12.5%vs. +9.4%).

The combination of these three trends points toward a favorable backdrop for investors in 2026. However, we continue to recommend a diversified and flexible portfolio philosophy, rather than chasing last year’s “winners” and shunning last year’s “losers.”

No one could have predicted the events of 2025 that we recapped above, but veteran investors know that every new year holds unexpected twists. As we noted many times throughout 2025, the best maxim for long-term investment success is “Patience and Discipline.”

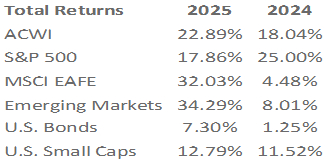

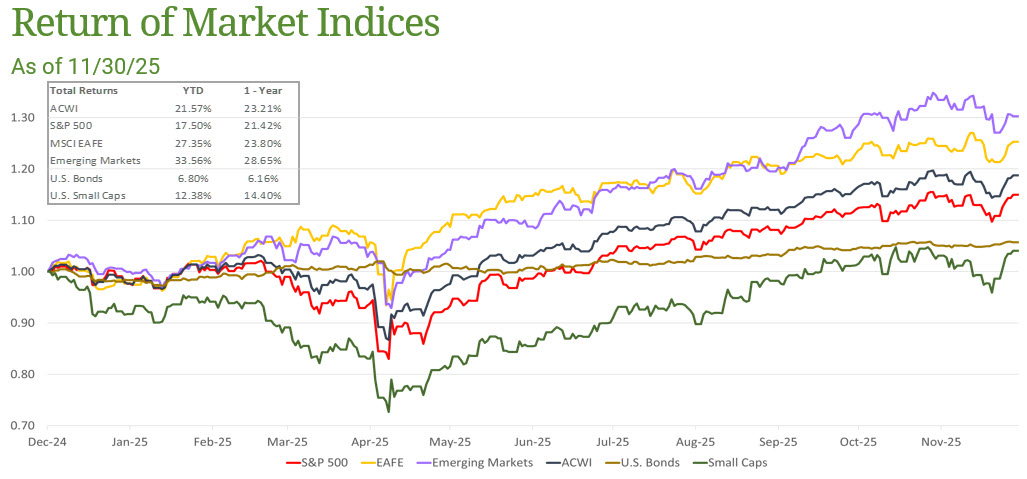

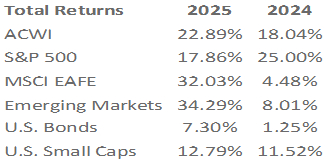

Capital Markets

December was a soft month for US investment returns, while overseas equities saw an appreciable rise. The All-Country World Equity Index (ACWI) rose 1%. Both Developed Non-US equities, as measured by the EAFE and Emerging Market Equities, as measured by the MSCI EM Equity Index, rose by 3%. The S&P 500 finished nearly flat for the second month in a row (+0.1%). Likewise, bonds as measured by Bloomberg’s US Aggregate index were nearly flat, declining by 0.2%. US Small Caps declined 0.6% for the month.

Source: Bloomberg. EAFE is MSCI EAFE Index(1), Emerging Markets is MSCI Emerging Markets(2) and U.S. Bonds is Barclays U.S. Aggregate(3). ACWI is the MSCI ACWI Index(4). Small Caps is the Russell 2000 Index(5). S&P 500 is the S&P 500 Index(6). The above information is as of 12/31/2025.

1 Since GDP is a measure of domestic production, imports represent foreign 2 production and thus are subtracted from the GDP calculation as these are already accounted for in domestic spending.

2 Source: FactSet Earnings Insight 12/19/25

3 The Magnificent 7 currently include Nvidia, Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), and Tesla. While Broadcom replaced Tesla as one of the 7 largest stocks in the S&P 500 by market capitalization, Tesla is still commonly included in the Mag 7 group.

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.