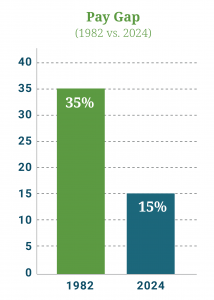

Despite significant progress in closing the gender pay gap, women have not yet achieved full equality. This year, Equal Pay Day falls on March 25th, signifying how far into the new year women have to work, on average, to earn what men had by the end of the year.

Pay Gap (1982 vs. 2024)1

Although the gap has narrowed, it still exists. If you have a daughter, granddaughter, or other young women in your life, here are some ways to help give them an edge.

- Teach Them to Negotiate

Negotiation is a powerful tool. Women who advocate for themselves can secure higher salaries, better benefits, and advance their career opportunities. Strategies for negotiation can include:

- Research market salaries using platforms like LinkedIn, Glassdoor, as well as professional networks to understand fair compensation. Many employers expect applicants to negotiate, yet only 32% of men and 28% of women do.2

- Demonstrate their worth by highlighting achievements, skills, and experiences that add value to an employer.

- Remember to request benefits, such as professional memberships and educational reimbursements, which can further enhance their careers.

- Choose employers wisely by seeking companies with strong diversity initiatives and a track record of supporting women.

- Discuss Career Choices Early

Throughout their lives, women face important career and life decisions — being informed will enable them to make the choices that align with their personal and financial goals. For example, according to a McKinsey study, men and women often have divergent career trajectories which contribute significantly to the wage gap. Even today, more women than men leave the workforce to be family caregivers or choose jobs that offer greater flexibility and fewer demands but often lower pay. This can result in fewer promotions and raises with a compounded impact adding up to about $500,000 dollars over a 30-year career.3 Encourage the young women in your lives to thoughtfully consider these factors and develop a plan that supports their long-term goals.

- Be a Changemaker

If you are a business owner, executive, or leader, you have the power to create an inclusive workplace. Support gender pay equity by:

- Advocating for transparent salary practices.

- Investing in mentorship and career development programs for women.

- Fostering a culture where women feel valued and empowered.

At Crestwood, we believe in taking meaningful action toward gender equity. As an early signer of the 100% Talent Compact with the Boston Women’s Workforce Council, we are committed to closing gender and racial wage gaps. Through this initiative, we actively support policies and practices that drive workplace equity. Learn more about this initiative here.

Shaping the Future

Academic success equips young women with knowledge, but navigating their career paths and financial futures requires additional guidance. As parents, grandparents, and mentors, we can teach the next generation the art of managing their life journeys — and how to mind the pay gap.

For further assistance and information on guiding your children along their wealth journey, please reach out to your Crestwood team.

Sources:

1Gender pay gap in U.S. has narrowed slightly over 2 decades, Pew Research Center, March 4, 2025

2 When negotiating starting salaries, most U.S. women and men don’t ask for higher pay, Pew Research Center, April 5, 2023

3Tough trade-offs: How time and career choices shape the gender pay gap, Anu Madgavkar, Kweilin Ellingrud, Sven Smit, Chris Bradley, Olivia White, and Kanmani Chockalingam, McKinsey Global Institute, February, 2025