The current energy shock has investors playing around with their portfolios to drive long-term success. Recently, CIO John Ingram spoke with ETF.com about the importance of digging into ETFs to find the proper exposure to match a set theme. Read the full story here.

Ukrainian War – A Humanitarian Disaster

A Humanitarian Disaster

Even as the war unfolds “live” in real time, it is hard to comprehend the scale of the humanitarian costs for those in Ukraine. Estimates already suggest that over 2 million refugees have fled the country. As the war drags on, Ukraine will face a rising death toll, shortages of essential goods and worsening of the crisis. The methods of the Russian President, Vladimir Putin, are ruthless and include the use of banned weapons on civilians. It appears that Putin will continue to escalate forces and tactics to bring Ukraine to its knees and, sadly, a truce seems distant. Surging Ukrainian national pride and a willingness to fight for their freedom, argues for a prolonged and destructive battle. Putin’s willingness to use force to obtain his larger goal of rebuilding the former USSR is a threat the world now takes seriously.

Though we are in the early days of this conflict, Putin’s aggression has many geopolitical implications. Since the invasion began, market volatility has jumped as investors have flocked to safe assets like U.S. Treasuries. More recently, the volatility has further increased as world leaders have acted with a high degree of unison in applying layer upon layer of sanctions. Notable was the first ever sanction of a central bank which froze most of Russia’s foreign reserve assets. On Monday, March 7th, selling pressure accelerated as many countries openly discussed banning Russian energy imports, sending gas and oil prices soaring.

Although the current volatility raises the appeal for investing in commodities, long-term returns for commodities have been pitiful. Since 2000, the S&P 500 is up 354% while a broad basket of commodities is up only 24%. Commodities generate returns through price change only, while stocks compound earnings and dividends. Over time this growth in earnings and dividends is a powerful driver of returns and builder of wealth in client portfolios.

Energy prices are at the nexus between war and sanctions. While countries are trying to maximize the effect of sanctions, Europe is reliant on Russia for 40% of their energy. Germany has few options to source their gas other than from Russian pipelines. Prices for natural gas in Europe have soared and are trading at approximately 15x natural gas prices in U.S.

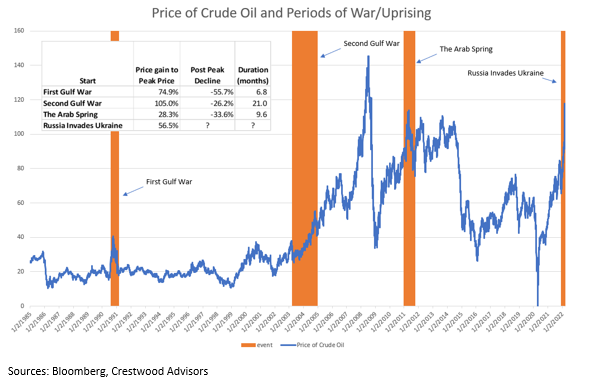

Historically, energy prices are cyclical, moving in tandem with economic growth and prices tend to fall sharply during recessions when demand slows. Wars in regions that produce energy typically cause energy prices to spike. These increases have historically proven to be temporary, except for the second Gulf War beginning in 2003, which was in the middle of a prolonged energy shortage. Prices tend to decline once supply chains and production levels adjust. Hence, these large price swings in commodities makes investment timing very difficult.

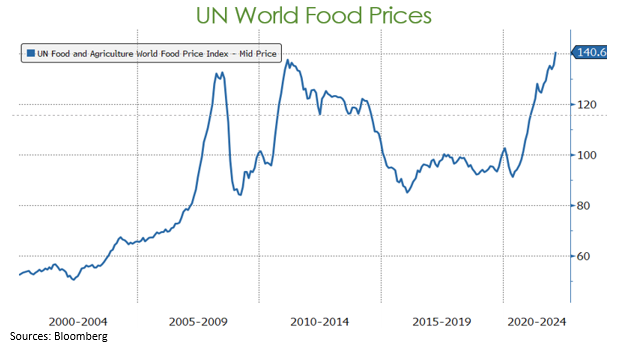

In addition to being significant world suppliers of oil and gas, Russia and Ukraine are also significant producers/exporters of important grains. As the chart below highlights, food prices have also risen to record highs.

U.S. Economy

From a U.S. economic perspective, the current invasion is likely to remain less impactful to domestic economic growth. While we do not want to minimize the human tragedy, over time, investment markets tend to follow “economic” events and, for better or worse, discount wars and other geopolitical events (see chart below). According to a Bloomberg survey of economists, global GDP estimates for 2022 have fallen from 4.5% to 4.3%, so economists are still expecting solid GDP growth.

Our base scenario remains that U.S. economic growth will remain healthy and equity investors will be rewarded for not panicking. That said, this conflict is a major and evolving humanitarian crisis, which will affect energy and commodity markets, particularly in Europe. We remain committed to well diversified portfolios that should serve as a buffer as we navigate through these challenging times. We will continue to make modest adjustments in client holdings where fundamentals remain healthy, and valuations are compelling. Please reach out to your Crestwood team if you have any specific market or portfolio questions or concerns.

Crestwood Fosters Talent Expansion – From A Distance

FOR IMMEDIATE RELEASE

Remote work success allows firm to continue along growth trajectory

Boston, Mass. (January 21, 2021) – Crestwood Advisors (“Crestwood”), a boutique investment and wealth management firm with offices in Massachusetts and Connecticut, today announced recent additions to its team of financial professionals and expansion plans for 2021.

Since switching to a remote work model in 2020, Crestwood has made five hires, including four at the end of the fourth quarter.

The latest team additions include:

- Greg McSweeney, CFA, Portfolio Manager

- Tiffany So, Client Advisor

- Nicholas Dipoto, Operations Specialist

- Joseph Bruno, Client Services Associate

- Olivia Godin, Client Advisor

“When the pandemic began, we weren’t sure how going virtual would impact team expansion, but we adapted quickly and it has worked in our favor as there has been a dramatic uptick in financial professionals who are looking for added flexibility, including remote work options,” said Crestwood CEO/Managing Partner Michael Eckton.

“Dynamic firms like Crestwood, who have embraced technology and the flexible work environment that will likely remain in place, may continue to have a competitive advantage in the recruitment and retention of employees,” Eckton added. “We’re thrilled to welcome our new teammates to add depth and expand client engagement in 2021.”

Increasing demands from high-net-worth individuals and families for comprehensive financial planning services and investment strategies has allowed Crestwood to continue growing. With its recent additions, the firm has surpassed 40 employees across three regional offices.

Crestwood leaders remain active in their remote recruiting efforts of wealth management professionals, including financial planners and portfolio managers to further enhance client support and achieve results that meet their current and future growth objectives.

About Crestwood Advisors

Crestwood Advisors is an independent, fee-only, wealth management firm with approximately $4 billion in assets under management. Founded in 2003, Crestwood Advisors provides investment management with financial planning strategies to help high-net-worth individuals and families identify and prioritize their goals and build sustainable wealth so that they may enjoy more financially secure and purposeful lives. For more information, please visit https://www.crestwoodadvisors.com.

Crestwood’s perspective on COVID-19’s economic impact

During this very difficult time, we thought it would be helpful to frame our observations around the impact the coronavirus may have on the U.S. economy and investment markets in the near-term future. To be sure, we do not have a “crystal ball” and with the situation remaining quite fluid and circumstances evolving rapidly, our observations are simply how we are seeing the events that are unfolding now.

Importantly, for our broader society, the human costs of the spreading virus will likely be far higher than the economic costs and sadly, for many families, the impact may be devastating for both their health and economic circumstances. The various efforts across the country to “social distance” and many state mandates to “stay home” are intended to suppress the spread of the virus and reduce the death toll and degree of human suffering. We are all hopeful that the result of these efforts will be a gradual mitigation of the virus and, eventually, a re-opening of our economy.

The impending economic contraction will be severe, perhaps the worst ever

There is no economic precedent for the broad-based work stoppage that is occurring and early data is bad. Initial jobless claims released yesterday rose to 3.28 million workers from 220 thousand in February. This level is the worst since the data collection started in 1966 and almost 5x the previous worst reading of 671k in 1982. GDP growth expectations have fallen sharply with the impact of Q2 GDP growth estimated to be down as much as -24%.

We expect some dislocation and defaults

Recently, bond markets have been dysfunctional, in many respects as bad as they were in 2008. The Fed has been very active over the past two weeks in supporting companies and providing liquidity. They have cut the discount rate, purchased bonds – Treasuries, municipals and mortgages – and reignited several funding programs to support liquidity needs in money market funds, foreign exchange markets, international bank lending, commercial paper, primary dealers and even purchased bond ETFs. These quickly implemented, large-scale actions have staved off possible systemic risks and have returned trading activity to some sense of normalcy.

We expect some corporate bond defaults and downgrades. The Fed is not supporting companies with poor credit ratings and it is reasonable to believe that there are many companies that are too levered and cannot survive +2 months of a shutdown. To be clear, your portfolios do not have exposure to high yield securities or junk bonds that might be most susceptible to default. The last several years have seen an enormous spike in BBB (or lower) debt issuance. BBB debt has grown to over 50% of the corporate bond market up from 17% in 2001. Companies whose debt is downgraded to junk bond status will have difficulty accessing funding and liquidity. For example, especially given the current price of oil, many energy companies are vulnerable and expected defaults are high in this sector. Over-levered retailers would be another area of obvious risk.

We are optimistic for an economic recovery and believe it may be surprisingly robust

After two months of lock-down and a dramatic slowdown in new coronavirus cases, Wuhan and the rest of China is returning to work. It will be important to watch for any resurgence of the virus, but for now, indicators like electricity and auto manufacturing are returning to levels approaching normal. While the U.S. is unlikely to return to work as early as Easter, the coronavirus will likely peak in the coming months and set the stage for a resumption of more normal economic activity later this summer.

This economic contraction is unlikely to be as deep as the 2008 Great Recession let alone the Great Depression. Numerous bodies of research studying recessions generally conclude that those recessions accompanied by a financial crisis tend to be longer and slower to recover. Recessions from financial crises tend to be worse because the banking sector/balance sheets are impaired, which significantly curtails loans and money growth. Currently, the U.S. banking system is in solid shape and in a much stronger financial position than in 2008. Banks now have almost 3x times more capital than in 2008 which provides a measure of safety for bad loans. Bank capital has increased on average from 2.5% to 6.6% of assets and bank funding is much more stable with banks relying more on deposits rather than short-term debt. Banks will certainly have some significant loan losses through this period, but we do not expect a banking crisis.

U.S. Monetary and fiscal stimulus has been massive. The U.S. government has rolled out over $2 trillion in fiscal stimulus which represents a whopping 9.2% of GDP. Additionally, the Fed has increased their balance sheet and is providing enormous liquidity to most markets. The combined monetary & fiscal policy is approaching $4 trillion. These packages may not completely offset the impending slowdown, but will certainly help now and when people return to work.

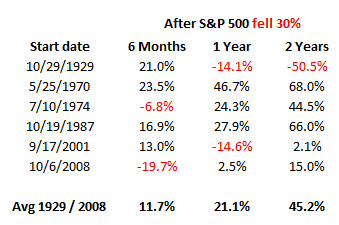

Stock market returns will likely stabilize and recover with the return of economic activity. Since 1928, the S&P 500 has had 6 prior periods when stocks fell from their highs -30% or more. Here are those periods and returns for 6 months, 1 year and 2 years after the market breached the -30% level:

Stock markets experienced strong and quick rebounds after the declines in 1970, 1974 and 1987 and were slower to recover from 1929 and 2008 given the accompanying financial crisis. 2001 is an exception, because the down -30% in the stock market was due to the “dot-com bubble” bursting which preceded the recession, so the timing is different. If you exclude periods with banking crisis (1929 and 2008), average returns after a 30% drop have been strong.

Asset Allocation and Portfolio Adjustments

We remain constructive on your current asset allocation. When the markets are volatile and experiencing significant (and likely, temporary) declines, we can add meaningful value by encouraging clients to stick to their long term goals and the supporting strategic asset allocation. While there are numerous adjustments we will continue to make to improve portfolios, we do not believe that making wholesale changes to portfolios, including selling all stocks, is in the best long-term interests of achieving your individual goals.

A major goal of our client asset allocation is greater consistency. Every client has a portfolio constructed and broadly aligned with a risk/return profile that is appropriate for their unique long term goals and risk tolerance. Our “growth seeking” clients can expect a portfolio that has +/-75% exposure to risk assets and +/-25% exposure to lower risk assets regardless of our view of the stock market. We firmly believe that one of our “value adds” as an advisor is carefully working with you to develop that long term strategy and making every effort to adhere to it. We have written numerous Perspectives pieces (on our website) on the topic of trying to anticipate market movements and how challenging that can be: Importance-of-time-and-diversification, Predicting-the-stock-market-is-a-bad-idea and Profiting-from-an-emotional-market.

Asset Allocation has been effective. Since 2/1/2020 more conservative portfolios have buffered the declines in stocks:

Source:Bloomberg

Source:Bloomberg

What would cause us to change our allocations and own fewer stocks? Our allocations are based on long term growth expectations and diversification. We expect stocks to continue their growth pattern similar to their 100+ year history that has delivered superior though sometimes erratic returns. If there was an event that somehow reduced long term growth of global economies, then we would consider changing allocations. Over the long run we expect growth in population, productivity, earnings and capital. We remain invested and optimistic that the coronavirus, though serious and unprecedented, will not disrupt long term growth and economic development. Negative news always receives more attention and the recent deluge is overwhelming. We fully recognize it is difficult to remain positive and focused on the long term but we believe that the U.S. and other countries remain an attractive place to invest and grow capital.

Looking to be opportunistic. As we have shared with many of you, we continue to review individual businesses and asset classes that are selling at now discounted valuations and we are actively seeking ways to enhance returns and your financial security.

We thank you for your continued confidence.

Sincerely,

Crestwood Advisors