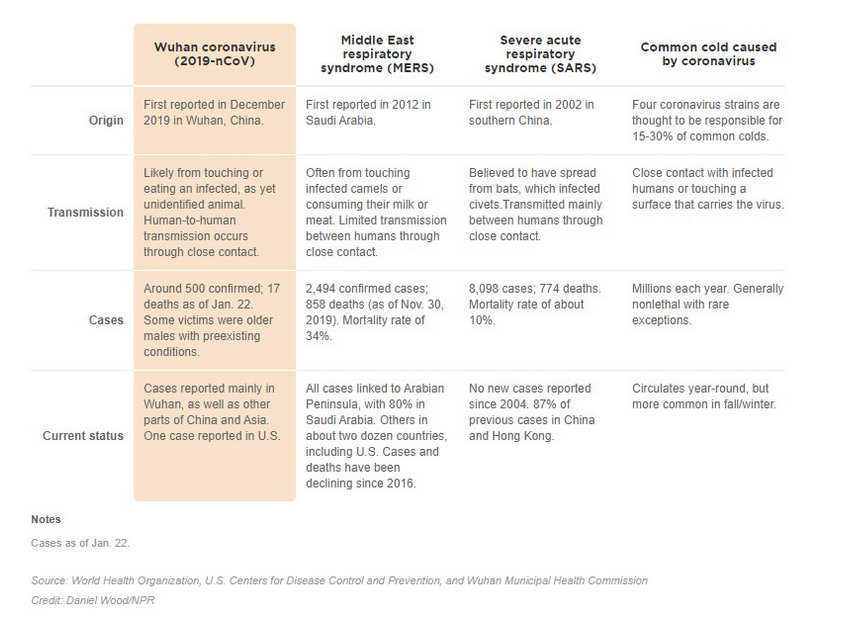

During this very difficult time, we thought it would be helpful to frame our observations around the impact the coronavirus may have on the U.S. economy and investment markets in the near-term future. To be sure, we do not have a “crystal ball” and with the situation remaining quite fluid and circumstances evolving rapidly, our observations are simply how we are seeing the events that are unfolding now.

Importantly, for our broader society, the human costs of the spreading virus will likely be far higher than the economic costs and sadly, for many families, the impact may be devastating for both their health and economic circumstances. The various efforts across the country to “social distance” and many state mandates to “stay home” are intended to suppress the spread of the virus and reduce the death toll and degree of human suffering. We are all hopeful that the result of these efforts will be a gradual mitigation of the virus and, eventually, a re-opening of our economy.

The impending economic contraction will be severe, perhaps the worst ever

There is no economic precedent for the broad-based work stoppage that is occurring and early data is bad. Initial jobless claims released yesterday rose to 3.28 million workers from 220 thousand in February. This level is the worst since the data collection started in 1966 and almost 5x the previous worst reading of 671k in 1982. GDP growth expectations have fallen sharply with the impact of Q2 GDP growth estimated to be down as much as -24%.

We expect some dislocation and defaults

Recently, bond markets have been dysfunctional, in many respects as bad as they were in 2008. The Fed has been very active over the past two weeks in supporting companies and providing liquidity. They have cut the discount rate, purchased bonds – Treasuries, municipals and mortgages – and reignited several funding programs to support liquidity needs in money market funds, foreign exchange markets, international bank lending, commercial paper, primary dealers and even purchased bond ETFs. These quickly implemented, large-scale actions have staved off possible systemic risks and have returned trading activity to some sense of normalcy.

We expect some corporate bond defaults and downgrades. The Fed is not supporting companies with poor credit ratings and it is reasonable to believe that there are many companies that are too levered and cannot survive +2 months of a shutdown. To be clear, your portfolios do not have exposure to high yield securities or junk bonds that might be most susceptible to default. The last several years have seen an enormous spike in BBB (or lower) debt issuance. BBB debt has grown to over 50% of the corporate bond market up from 17% in 2001. Companies whose debt is downgraded to junk bond status will have difficulty accessing funding and liquidity. For example, especially given the current price of oil, many energy companies are vulnerable and expected defaults are high in this sector. Over-levered retailers would be another area of obvious risk.

We are optimistic for an economic recovery and believe it may be surprisingly robust

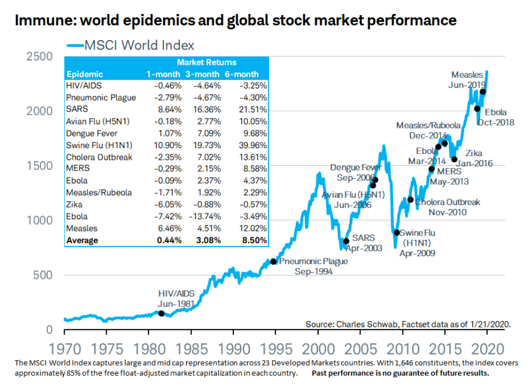

After two months of lock-down and a dramatic slowdown in new coronavirus cases, Wuhan and the rest of China is returning to work. It will be important to watch for any resurgence of the virus, but for now, indicators like electricity and auto manufacturing are returning to levels approaching normal. While the U.S. is unlikely to return to work as early as Easter, the coronavirus will likely peak in the coming months and set the stage for a resumption of more normal economic activity later this summer.

This economic contraction is unlikely to be as deep as the 2008 Great Recession let alone the Great Depression. Numerous bodies of research studying recessions generally conclude that those recessions accompanied by a financial crisis tend to be longer and slower to recover. Recessions from financial crises tend to be worse because the banking sector/balance sheets are impaired, which significantly curtails loans and money growth. Currently, the U.S. banking system is in solid shape and in a much stronger financial position than in 2008. Banks now have almost 3x times more capital than in 2008 which provides a measure of safety for bad loans. Bank capital has increased on average from 2.5% to 6.6% of assets and bank funding is much more stable with banks relying more on deposits rather than short-term debt. Banks will certainly have some significant loan losses through this period, but we do not expect a banking crisis.

U.S. Monetary and fiscal stimulus has been massive. The U.S. government has rolled out over $2 trillion in fiscal stimulus which represents a whopping 9.2% of GDP. Additionally, the Fed has increased their balance sheet and is providing enormous liquidity to most markets. The combined monetary & fiscal policy is approaching $4 trillion. These packages may not completely offset the impending slowdown, but will certainly help now and when people return to work.

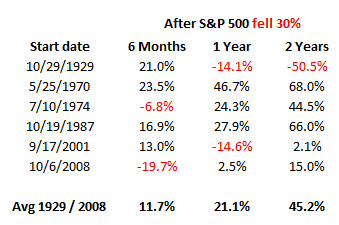

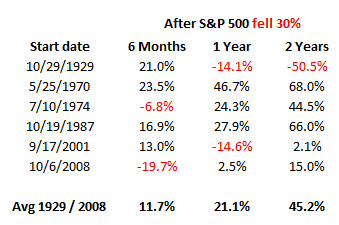

Stock market returns will likely stabilize and recover with the return of economic activity. Since 1928, the S&P 500 has had 6 prior periods when stocks fell from their highs -30% or more. Here are those periods and returns for 6 months, 1 year and 2 years after the market breached the -30% level:

Stock markets experienced strong and quick rebounds after the declines in 1970, 1974 and 1987 and were slower to recover from 1929 and 2008 given the accompanying financial crisis. 2001 is an exception, because the down -30% in the stock market was due to the “dot-com bubble” bursting which preceded the recession, so the timing is different. If you exclude periods with banking crisis (1929 and 2008), average returns after a 30% drop have been strong.

Asset Allocation and Portfolio Adjustments

We remain constructive on your current asset allocation. When the markets are volatile and experiencing significant (and likely, temporary) declines, we can add meaningful value by encouraging clients to stick to their long term goals and the supporting strategic asset allocation. While there are numerous adjustments we will continue to make to improve portfolios, we do not believe that making wholesale changes to portfolios, including selling all stocks, is in the best long-term interests of achieving your individual goals.

A major goal of our client asset allocation is greater consistency. Every client has a portfolio constructed and broadly aligned with a risk/return profile that is appropriate for their unique long term goals and risk tolerance. Our “growth seeking” clients can expect a portfolio that has +/-75% exposure to risk assets and +/-25% exposure to lower risk assets regardless of our view of the stock market. We firmly believe that one of our “value adds” as an advisor is carefully working with you to develop that long term strategy and making every effort to adhere to it. We have written numerous Perspectives pieces (on our website) on the topic of trying to anticipate market movements and how challenging that can be: Importance-of-time-and-diversification, Predicting-the-stock-market-is-a-bad-idea and Profiting-from-an-emotional-market.

Asset Allocation has been effective. Since 2/1/2020 more conservative portfolios have buffered the declines in stocks:

Source:Bloomberg

Source:Bloomberg

What would cause us to change our allocations and own fewer stocks? Our allocations are based on long term growth expectations and diversification. We expect stocks to continue their growth pattern similar to their 100+ year history that has delivered superior though sometimes erratic returns. If there was an event that somehow reduced long term growth of global economies, then we would consider changing allocations. Over the long run we expect growth in population, productivity, earnings and capital. We remain invested and optimistic that the coronavirus, though serious and unprecedented, will not disrupt long term growth and economic development. Negative news always receives more attention and the recent deluge is overwhelming. We fully recognize it is difficult to remain positive and focused on the long term but we believe that the U.S. and other countries remain an attractive place to invest and grow capital.

Looking to be opportunistic. As we have shared with many of you, we continue to review individual businesses and asset classes that are selling at now discounted valuations and we are actively seeking ways to enhance returns and your financial security.

We thank you for your continued confidence.

Sincerely,

Crestwood Advisors

Source:Bloomberg

Source:Bloomberg