November saw a convergence of three storms of worry from investors: doubts about the continuing run-up of AI-themed stocks, lack of access to economic data because of the government shutdown, and mixed messages about the Fed’s next move.

While uncertainty will persist, we expect the three trends outlined below to form a durable engine for corporate earnings growth, providing fundamental support for market valuations into 2026.

Trend #1: Economic Resilience and Pro-Growth Fiscal Policy

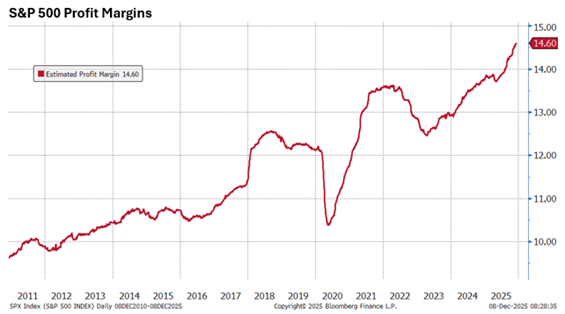

- Healthy Corporate Fundamentals: Corporate balance sheets remain generally sound. The confluence of lower financing costs and productivity-driven earnings growth creates a powerful backdrop for sustained profit. As the chart below illustrates, margins have been rising for years, and AI has the potential to further this trend.

- Wealth Effects and Spending Power: Despite ongoing uncertainty around policies like tariffs and reduced immigration, the consumer remains supported by low unemployment and the wealth effects of rising asset prices. As a result, consumer spending continues to provide a strong floor for corporate revenue expectations.

- Targeted Fiscal Stimulus: The long-term effects of infrastructure bills and tax cuts from the One Big Beautiful Bill will continue to feed into the economy, promoting targeted investments in key sectors and ensuring U.S. GDP growth remains at or above trend.

Source: Bloomberg. The above information is as of 12/08/2025.

Trend #2 Monetary Policy Normalization: Lower Rates and Valuation Support

The Federal Reserve’s ongoing pivot from a restrictive stance to neutral will be a meaningful tailwind. As inflation pressures ease, the Fed is anticipated to execute further interest rate cuts through 2026, fundamentally altering the calculus for risk assets. The result:

- Decreased Cost of Capital: Lower rates reduce corporate borrowing costs, supporting both capital investment tied to the AI transition, increased share repurchases and additional M&A activity, all of which support equity valuations. Likewise, lower rates act as a potential tailwind to make consumer borrowing more affordable (lower costs for mortgages, car loans, and credit cards).

- Lowering the Discount Rate: The Discount Rate is a financial hurdle that a potential investment must exceed to be worth your time and money. This is the opportunity cost for investors choosing a very low risk asset (ex: cash or CDs) versus a higher risk asset with more potential return (ex: equities). Lower interest rates reduce the relative appeal of low risk-assets and support higher stock market valuations.

- Support for Cyclical Sectors: While financial markets react relatively quickly to lower rates, the impact on the economy takes more time and can lag by 6-12 months. We are just starting to see the boost to rate-sensitive and cyclical sectors of the market that underperformed during the higher rate environment.

Trend #3: The Transition of AI Investment from Hype to Productivity

While the initial waves of AI investment favored companies directly involved in development like semiconductor and cloud infrastructure firms, the 2026 narrative is set to shift toward enterprise adoption and tangible productivity gains.

- Sustained IT Infrastructure Spending: The build-out of data centers and the proliferation of number-crunching semiconductors is expected to continue at a staggering pace in 2026. While this spending will likely eventually slow, these multi-year projects which are still underway. This monumental capital expenditure acts as an economic stimulus and directly feeds the revenues of the hardware and infrastructure sectors.

- Operating Leverage Expansion: As publicly traded companies outside the tech sector embed AI into their operations, we expect meaningful gains in operating leverage. Efficiency improvements spanning R&D, supply chains, and customer service should translate directly into higher profit margins.

- Revaluation Driven by Innovation: The market is likely to reward a broader set of companies that demonstrate clear, measurable Return on Investment (ROI) from their AI investments. This dynamic supports a re-rating of valuations for high-quality firms that translate AI adoption into new revenue streams and improved profitability.

Implications for Investors

Collectively, these three trends suggest a favorable backdrop for investors in 2026. Short-term market movements will continue to be driven by macro data releases, like the whipsaw market reaction to the September revised job report and speculation around Fed rate cuts. However, long-term focus should remain on measured investment in companies positioned to capitalize on the coming productivity boom, supported by a constructive shift in monetary policy. As always, patience and remaining invested for the long-term are the best approaches.

Capital Markets

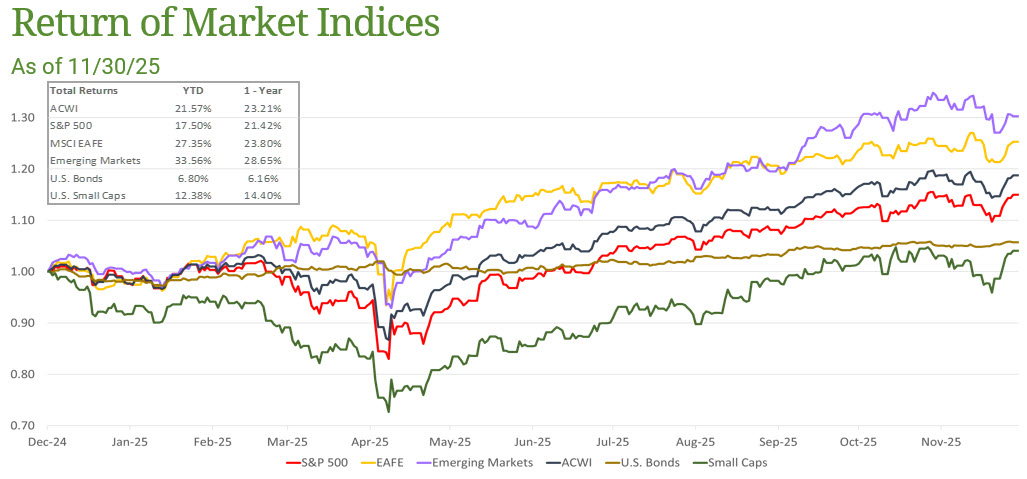

November was a volatile month for markets as investors fretted over the possibility of the Fed potentially changing course on rates. The All-Country World Equity Index (ACWI) and S&P 500 both finished nearly flat (+0.02% and +0.25% respectively) after a mid-month drop of close to 4%. US Small Cap equities, measured by the Russell 2000, finished up by close to 1% (+0.96%) but saw an even larger intramonth swing, dropping over 6% briefly. International Developed stocks, as measured by the EAFE, were less influenced by US interest rate worries and increased by 0.65%. Emerging market equities reversed course after last month’s strong performance, dropping 2.38% for the month. US bond prices rose 0.62% for the month.

Source: Bloomberg. EAFE is MSCI EAFE Index(1), Emerging Markets is MSCI Emerging Markets(2) and U.S. Bonds is Barclays U.S. Aggregate(3). ACWI is the MSCI ACWI Index(4). Small Caps is the Russell 2000 Index(5). S&P 500 is the S&P 500 Index(6). The above information is as of 11/30/2025.

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.