Open enrollment is just around the corner. This is the time not only to review your coverage for 2026, but also to consider how healthcare expenses fit into your financial plan for today and for the future.

Advances in healthcare are making it easier than ever to take charge of your own well-being. From wearable fitness trackers that monitor steps, sleep, and heart health to telemedicine that delivers care without the waiting room, convenience and accessibility are on the rise. For those seeking more personalized options, concierge medicine provides direct access to physicians, while GLP-1 medications and luxury wellness treatments are becoming increasingly popular.

Thanks to these innovations, many Americans can expect to live into their 90s and beyond with a high quality of life.

But What’s the Cost?

Many of these advances are not covered by insurance. It is easy to underestimate the lifetime price tag, especially as you age. Fidelity estimates that the average 65-year-old couple retiring today will need $345,000 for healthcare in retirement, not including long-term care.1

Chronic conditions, rising drug prices, or an unexpected diagnosis can quickly derail even the best-laid plans. Without planning, families often find themselves self-funding significant healthcare expenses, so it is important to plan for both the expected and the unexpected.

When You’re Just Starting Out

If you’re under 26 years old, you may still qualify to stay on your parents’ health insurance plan, potentially saving thousands in premiums.

If you’re enrolled in a high-deductible health plan, consider contributing to a Health Savings Account (HSA). While many people use HSAs for current medical costs, their real power lies in the potential to invest for long-term growth. HSAs offer unique triple-tax advantages:

- Contributions are tax-deductible

- Growth is tax-free

- Withdrawals for qualified medical expenses are tax-free

As You Advance in Your Career

As your income and financial assets grow, start setting aside funds earmarked for healthcare, separate from lifestyle spending. This is especially important if you’re considering retiring before age 65 (when you are eligible for Medicare) and need to fund your own healthcare plan.

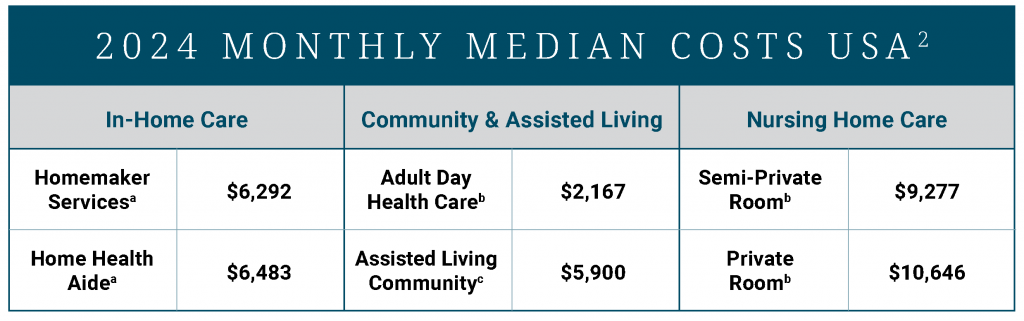

Expenses such as in-home care, community and assisted living, and nursing home care are expensive and not covered by Medicare. Self-funding can be a valid strategy for high-net worth individuals. Long-term care insurance can also help cover all or a portion of those expenses. The best time to begin evaluating long-term care insurance is when you’re in your 50s or early 60s, when premiums are still reasonable and you have more options available.

a Based on annual rate divided by 12 months (assumes 44 hours per week)

b Based on annual rate divided by 12 months

c As reported, monthly rate, private, one bedroom

After You Have Retired

Budgeting becomes increasingly important in retirement. Healthcare costs often rise with age, and unexpected expenses can strain your savings if you’re not prepared. Your Crestwood advisory team can help you create a withdrawal strategy that allows your money to last throughout retirement and cover your healthcare expenses when you need them the most.

Reach Out to Crestwood

Modern healthcare gives us the tools to live longer, healthier lives, but it also requires thoughtful financial planning. We help clients invest for a future they can enjoy. If you are not yet a Crestwood client, please contact us to see how we can help you invest in your health at every age.

Sources:

1 Fidelity Investments. (2025, July 30). Fidelity Investments® Releases 2025 Retiree Health Care Cost Estimate, a Timely Reminder for All Generations to Begin Planning. https://newsroom.fidelity.com/pressreleases/fidelity-investments–releases-2025-retiree-health-care-cost-estimate–a-timely-reminder-for-all-gen/s/3c62e988-12e2-4dc8-afb4-f44b06c6d52e#_edn1 (Visited September 2025).

2 Genworth | CareScout®. Calculate the cost of long-term care near you. https://www.carescout.com/cost-of-care?os=wtmb5utkcxk5ref%3Dapp&ref=app (Visited September 2025).

This document is provided for general informational purposes only by Crestwood Advisors, an investment adviser. Crestwood Advisors does not provide legal advice, and this document should not be construed as containing legal advice. For legal advice, consult with a licensed attorney. This document should not be construed as containing tax advice. For tax advice, consult with your tax adviser.