For many of us, college was a transformative chapter filled with learning, growth, and the beginnings of lasting friendships. It’s also where career paths begin to take shape, making it one of the most significant investments you can make in your children’s future.

There is nothing a parent wants more than the best education for their children, and it’s never too soon or too late to start planning. To help support your children’s educational goals, consider these five important steps:

Discuss how you’d like to support your child’s education. Before crunching numbers or filling out FAFSA forms, take a moment to step back and have a thoughtful family conversation about what college support means to you. Every parent brings different values, beliefs, and experiences to the table. Some parents prioritize fully covering tuition so their children can graduate debt-free. Others feel it’s important for their children to contribute, whether through work, loans, or scholarships, so they have some “skin in the game.” In some families, grandparents or other relatives offer to help, while in others, loans may be the only realistic path. There’s no one right answer. What matters is clarifying your family’s intentions, limitations, and hopes around paying for college. This shared understanding is the foundation for building a plan that aligns with both your financial reality and your core values.

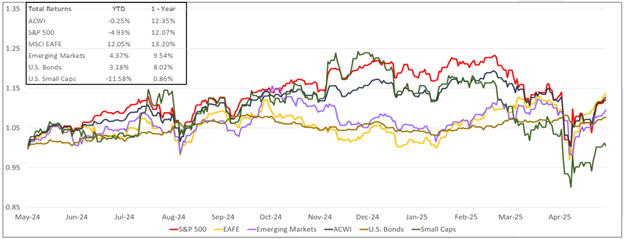

Set your savings target. When planning for your child’s future, it’s important to consider how much a college education might cost by the time they’re ready to enroll. As of 2025, the average annual cost of attendance is $25,668 for in-state public colleges and $60,358 for private universities.¹ However, these figures are just averages, actual costs can vary widely. In fact, attending a top-tier private college can cost nearly $100,000 per year.² Should college attendance be several years away, be cognizant that tuition and related expenses are expected to rise, which often outpace the rate of inflation.

Many parents ask if they should save the full amount. While we all hope our children might earn a generous merit scholarship, become standout athletes, or contribute financially themselves; planning to cover the full cost remains the most reliable strategy for meeting your family’s education goals. Your Crestwood team can work with you to create a personalized financial plan that incorporates college savings as part of your overall wealth strategy.

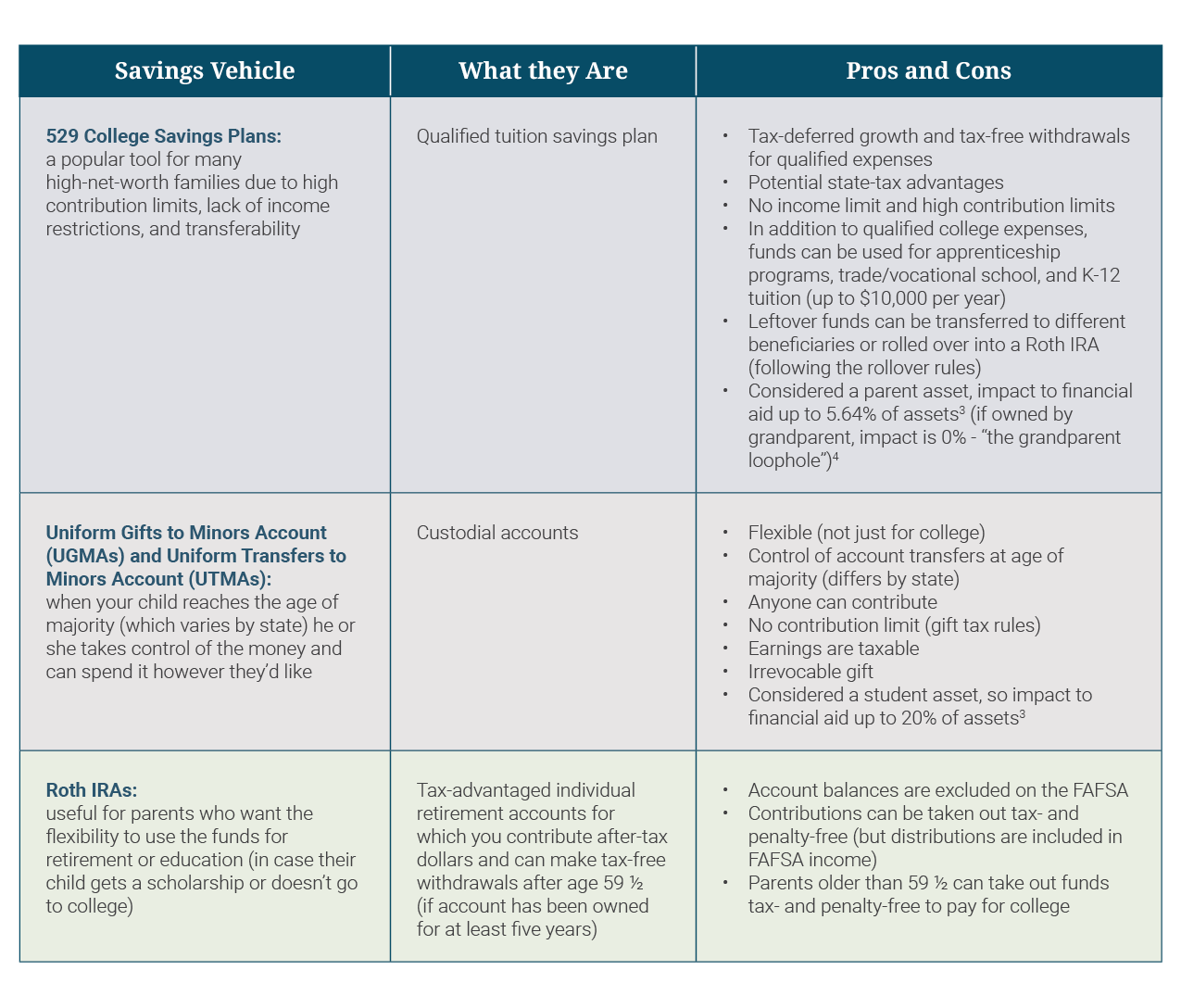

Choose how to save. There are several college savings options to consider, including:

Invest the assets. Your Crestwood team can help you invest your college savings using an asset allocation strategy tailored to your children’s timeframe and educational goals. We will also work with you to reassess your strategy over time, as your children get closer to college enrollment or if they graduate with leftover funds.

Reach Out to Crestwood. When the college acceptance notices arrive, will you be ready to pay the bill? Turn to your Crestwood team for guidance on college savings as part of your comprehensive wealth plan. The sooner you begin planning, the better.

If you are not yet working with Crestwood, please contact us to start a conversation about college planning and your broader wealth management goals.